Scroll to:

Valuation of non-producing mining companies

https://doi.org/10.17073/2500-0632-2025-06-426

Abstract

It is not unusual for the valuations of mining companies and projects to be debated by mining investors, analysts and regulators. Difficulties understanding geological information, volatility of metals prices, high investment risks and poor historical returns on capital in the mining industry are among the reasons. An additional and important factor is the varying risk profile at different stages of a mining project. A non-zero probability of not advancing to production for a project with a positive feasibility study (FS) requires a careful analysis of its valuation methods and supportive data. Because each mining project is different, and public mining companies are a small part of the market, it's hard to compare them accurately. Once a company prepares a mineral resources report, the exploration costs cease to be a relevant value metric. We offer a practical valuation method for non-producing mining companies, accounting for development stage risks to determine market value. Recognizing the specific attributes of the mining industry, we show that the NPVs calculated using the expected cash flows and discount rates developed using the traditional CAPM framework provide realistic estimates of the project’s value, that compare well to the market indications for the peer groups. We are also investigating the large gap between the NPV values in technical reports and the actual market values of mining companies.

Keywords

For citations:

Lopatnikov A.N., Rumyantsev A.Yu. Valuation of non-producing mining companies. Mining Science and Technology (Russia). 2025;10(3):306-316. https://doi.org/10.17073/2500-0632-2025-06-426

Valuation of non-producing mining companies

Introduction

Valuing mining companies and projects in the early stages is considered more difficult than valuing an average company in most other industries, except for pharmaceutical companies, which have a similar risk profile. The reasons mining companies are difficult to value include challenges interpreting geological information, several distinct development stages of a project and the binary nature of risks at the exploration stage, the high volatility of metal prices, and the relatively small size of both the industry and most mining companies. This, combined with the fact that many companies in the industry are not publicly traded, makes some investors believe that valuation methods used in finance are not suitable for assets with this type of risk profile.

The purpose of this article is to explain the reason for the differences between NPV in technical reports and fair values, as well as to offer a way of assessing the market value of companies and projects with feasibility studies prepared, but before the start of mine construction and production. To achieve this purpose, the study addresses the following three issues. First, we identify and systematize the factors explaining the large differences between the NPV values provided in technical reports and the market values of mining projects. Second, we propose a practical approach to selecting a discount rate developed using the CAPM model that considers the changing risk profile of a mining project. Lastly, we compare the value estimated using the proposed approach with market multiples based on market capitalization.

NPV and public disclosure standards

Despite the unique characteristics of mining assets and the variety of methods available to investors for their valuation, they are all variations of one of three basic valuation methods or approaches: comparison with similar or comparable assets, justified equivalent costs, or the present value of the expected income.

NI 43–101 Standards of Disclosure for Mineral Projects, and a companion Form 43-101F1, require Technical Reports of the public companies (Preliminary Economic Assessments (PEA), Pre-Feasibility Studies or Feasibility Studies) to include a section with economic analysis and its key assumptions. Specifically, Form 43-101F1 requires the report to include «a discussion of net present value (NPV), internal rate of return (IRR), and payback period of capital with imputed or actual interest».

Neither the JORC Code 2012 nor the 2024 draft mentions NPV or requires its calculation disclosed in public reports [1]. However, the JORC Code requires disclosing all material information that impacts the economics of a particular mining project. This information includes economic assumptions considered in developing the modifying factors (i.e. mining method, processing, metallurgy, infrastructure, as well as economic, marketing, legal, social factors, including environmental and regulatory requirements) which must be included in technical reports with estimates of mineral resources and reserves.

In theory, NPV can be used to estimate the value of any asset; however, not every estimate of NPV results in the market value. The intended use of NPV defines how the key parameters are estimated, i.e. cash flows and discount rate. The main goal of estimating IRR and NPV in technical reports is to test if the project is economically feasible. Positive NPV means the project can be undertaken [2].

As a result, a useful practice of disclosing mining project NPV in public reports becomes a reason for confusion, since those NPVs have nothing to do with the market value of the project. Explaining the nature of value creation in mining and the confusion that arises from misinterpreting the intent of the technical reports vs market valuations, Michael Samis [3] noted that «Industry professionals and observers are often confused by the large difference between an exploration company’s market cap and the NPV reported in its project NI43-101». NPVs provided in technical reports or announcements of public companies often tend to be significantly higher than market capitalization. An analysis of 100 mining projects in 2024 [4] showed that NPV reported in Feasibility Studies were on average 40–60 % higher than their market values.

It is not unusual to see NPV of hundreds of millions of US dollars reported in a Pre-feasibility Study (PFS) or Feasibility Study (FS) by a company with a market capitalization of a few tens millions of dollars or less. A recent example is TriStar Gold’s May 2025 announcement about the updated PFS that notes “There was no change to the mineral resources or reserves, the focus of the update study was the cost estimate since the release of the previous PFS, as well as to incorporate changes to the gold price and exchange rates.” [5]. The markets positively reacted to the doubling of the project’s NPV from 321 to 603 million US dollars in the updated PFS (calculated using USD2,200/oz and 5% discount rate)1. At the same time the reaction to the increased NPV was rather subdued, the market capitalization of the company increased by 9.1% to reach USD36.5 million, which is roughly one-sixteenth of the NPV reported in the PFS.

Another example [6] is the updated Feasibility Study on a lithium project in Canada prepared by Frontier Lithium. The company with a market capitalization of USD90 million reported an NPV@8% of USD932 million.

The magnitude of the difference is way too high to assume a systematic mispricing of the mining projects by the markets. Neither can it be explained by the difference in the estimates made using different valuation approaches, e.g. comparative vs income based. In the following sections we explain that this value dichotomy is not a bug, but a feature of the mining companies at the exploration stage or Feasibility Study projects that did not reach mine construction and production phase.

1 At 10% discount rate NPV was calculated by the company to be equal USD393 million

NPV, Technical Value and Market Value

NPV logic is implicit in the definition of “Technical Value” in the VALMIN mineral assets and company valuation code, defined as follows «Technical Value is an assessment of a Mineral Asset’s future net economic benefit at the Valuation Date under a set of assumptions deemed most appropriate by a Practitioner, excluding any premium or discount to account for market considerations.».

The term “Technical Value” is not used or mentioned in the International Valuation Standards (IVS), International Financial Reporting Standards (IFRS) or economic literature. However, it is essentially an NPV developed using certain subjective inputs, raises questions and confuses. In the latest version, VALMIN attempted to harmonize its definitions with IVS. It was done in a clarifying statement that Technical Value is equivalent to Investment Value in IVS. In our view it is not much of an improvement, since Investment Value under IVS is often nothing more than an NPV calculated using subjective user-specific assumptions. IVS2025 defines Investment Value as “the value of an asset to a particular owner or prospective owner for individual investment or operational objectives.”

The assumptions used to calculate NPV in Technical Reports that make it significantly different from market value are as follows:

- Use of a single set of cash flows instead of the expected cash flows. This approach implies that the project is guaranteed to reach production, and that its technical parameters, schedule and economic results will match the model.

- Use of a “standardized” discount rate (normative), that does not reflect the risks and the cost of capital for the project during exploration and evaluation stages.

The first assumption could be appropriate for the valuation of an existing mine that reached the planned production level and sales volumes. However, even in this case, the use of a single discount rate for all projects is hard to justify for estimating the market value.

Based on empirical data, A. Dixit and R. Pindyck [7], noted that in financing new projects, investors tend to use not the opportunity cost or corporate WACC, developed using CAPM (Capital Asset Pricing Model), but a hurdle rate, which is much higher in real terms. The statistics of the mining industry show that the probability of a project reaching the stage of mine construction and production varies over life of the project. Even for bankable Feasibility Study projects this probability is markedly lower than 100%. The planned mining volumes cannot be achieved or be achievable for various reasons outside of the company’s control. The research on the probability of mining companies failing to reach the stage of mine construction and production is limited. However, the available studies consistently report similar chances of moving between the stages for projects, that could be considered as a rough estimate of the risks at the respective stages.

It should be noted that the “stage” of a mining project is a broadly defined term subject to interpretation. The CIMVAL mineral valuation code mentions that «As applied to Mineral Properties, the Valuation approach depends on the stage of exploration or development of the Mineral Property. Mineral Properties can be categorized for convenience into four types; however, it should be noted that there are no clear-cut boundaries between these types, that the Mineral Property category may change over time, and that it may be difficult to classify some Mineral Properties so they fit in only one specific category.» [8].

Mining projects can be divided into the following broad groups with significantly different risk profiles:

- Prospecting and exploration projects without mineral resources

- Projects with mineral resources and reserves before final investment decision (FID) and mine construction

- Built and producing mines.

It is reasonable to expect that for the projects with resources and reserves, estimated according to one of the internationally accepted codes based on the CRIRSCO template, the stage of development will inversely correlate with their riskiness hence, positively correlate with their value, ceteris paribus. That said, no exploration or evaluation can ever remove all risks and uncertainties of a mining project. This explains why investors’ valuations of FS stage non-producing projects and producing mines differ.

Statistics that help better understand the risks of mining projects at different development stages were provided by J.P. Syles and A. Trench [9] in their study of global copper projects. The authors noted that a pyramid representation is the best illustration of “a flow of many projects to few through a hierarchical or linear stage-gating system.”

To illustrate the approximate probability of a mining project advancing to the next stage, in Table 1 we use the findings of the study to show the percentages at respective development stages.

Table 1

Global copper projects hierarchy

Project development stage | Construction and production | FS | PFS | Advanced Exploration | Early Exploration |

Number of projects at this stage | 66 | 75 | 92 | 664 | 2,870 |

Percentage of projects at this stage vs previous stage | 88 % | 82 % | 14 % | 23 % | N/A |

According to J.P. Syles and A. Trench ”As well as the expected large number of projects that do not make it from the raw prospect or early exploration stages into the advanced exploration stages, as would be expected, a significant number do not also make it from advanced exploration to prefeasibility. The approximate percentage not converting from advanced exploration to prefeasibility is about 85 per cent in this sample, a greater percentage than the amount not making it from early exploration to advanced exploration (about 75 per cent). This suggests that a significant number of projects have an advanced level of exploration conducted on them, only to then subsequently prove uneconomic.”

Similar findings reported by others [10] are illustrated in Table 2.

Table 2

Probability of Success at Different Phases of Development

Year | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Probability of Success, % |

Quarter (Q) | Q1–Q4 | Q1–Q4 | Q1–Q4 | Q1–Q4 | Q1 | |

Profile Engineering | 50% | |||||

Conceptual Engineering | 70% | |||||

Basic Engineering | 90% | |||||

Production | 100% |

AMC data [11] suggests that around 25% of FS projects fail. McKinsey (2017) [12] estimates that only 20% of FS stage mining projects were built as planned initially, many experienced multi-year delays and had lower parameters than planned. Other researchers found that 30% of mining projects do not advance beyond Feasibility Study because of problems obtaining regulatory approvals, technical issues, or failing to attract financing.

Table 3 illustrates the taxonomy of main development stages and appropriate valuation methods provided in VALMIN, CIMVAL, and SAMVAL mineral valuation codes.

Table 3

Comparative illustration of project stages and valuation methods

Valuation Approach | Applicability to Respective Project Stage | ||||

Market Approach | Income Approach | Cost Approach | VALMIN | CIMVAL | SAMVAL |

YES | NO | YES | Exploration projects | Exploration Projects | Early-stage exploration |

YES | In some cases | In some cases | Pre-Development Projects | Mineral Resource Properties | Advanced stage exploration |

YES | YES | NO | Development Projects | Development Projects | Development properties |

YES | YES | NO | Production Projects | Production Projects | Production properties |

NA | NA | NA | NA | NA | Dormant properties |

NA | NA | NA | NA | NA | Defunct properties |

Explaining the limitations of NPV for valuing mining projects P.F. Bruce [13] argued ”The NPV-DCF method is invaluable for comparing the worth of various advanced exploration properties particularly those with similar technical and financial parameters. It is not appropriate to use the method rigorously on an Exploration Property which lacks the necessary technical and commercial parameters needed to properly apply the method. Any attempt to ‘invent’ parameters to engender the cash flow with some semblance of reality can be most misleading to the inexperienced or uninformed. Nevertheless, a crude conceptual cash flow model based on best judgement expectations of future mineral resource parameters is a useful in-house technique for putting an Exploration Property into perspective to support a ‘value’ or for justification of further exploration expenditure. The method applied to an Advanced Exploration Property will provide an indication of the value for ‘what can be seen’ on the property.”

It is fair to say that public companies’ disclosures note that NPV provided in the technical report does not reflect the project’s market value, which is often shown separately to illustrate the difference. As an example, presenting the results of a PFS prepared to restart its Madsen Mine, West Red Lake said the following “Madsen Mine NPV is CAD$496 million using long-term gold price of USD2,640/oz. Developers often valued at ~0.4 times their asset value. Producers often valued between 0.7 and 1.0 times their asset value. WRLG’s market capitalization is ~CAD$300M today.” Market capitalization did not change much after the mine restarted in May 2025 [14].

Why do the NPVs reported in PEA, PFS, or FS not represent market value?

Large differences between NPV reported in a PFS or FS and the market value of the mining project are explained by recognizing that a Feasibility Study is essentially a marketing product, supported by certain research and quantitative estimates. Its primary goal is “to sell” the project to investors. Investors usually consider not one project but select between several investment alternatives, making the use of a “single” discount rate appropriate. The task of the investor, therefore, is to make the right choice, not to estimate the market value of the specific investment.

For NPV to yield an estimate of the market value, the calculations should use the assumptions implicit in the market value definition and market inputs [15]. Mathematically, it means one should use the expected cash flows and the discount rate reflecting the risks of the projects. The main reason why NPV in a Feasibility Study differs from the market value is that the above conditions are not met.

The risks of a mining project can be accounted for in one of two key components of NPV, i.e. expected cash flows and/or the discount rate. Table 4 shows the examples.

Table 4

Accounting for risk when estimating the market value using NPV

Risk | Better modeled in | Comments |

Systemic/Market risks | Discount rate | Expected return or return on an alternative investment |

Time value of money and inflation | Discount rate | Present value |

Financial risks | Discount rate | Uncertainty premium |

Operating/project risks | Cash flows | Provisions for planned costs and contingencies |

Technical and regulatory risks | Cash flows | Delays, likelihood of failure, cost overruns |

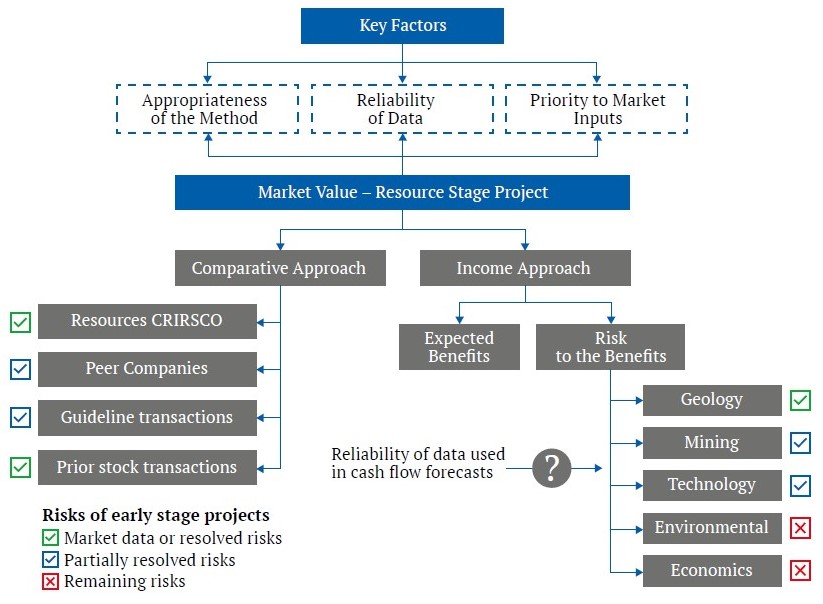

Fig. 1 illustrates the risk structure of an exploration project. An estimate of value of a resource or reserves stage project can be made using a resources-based multiple or cash flows analysis, where exploration and evaluation data support it.

Fig. 1. Key factors and risks to be considered in valuations of exploration projects

The fact that a company reported mineral reserves in a Pre-feasibility or Feasibility Study does not mean that all material risks of the project were removed; the remaining risks need to be reflected when estimating the market value of the project using NPV. Failing to do it is a major reason behind the differences between the valuations based on market multiples that use peer group market capitalization and NPVs in the technical reports.

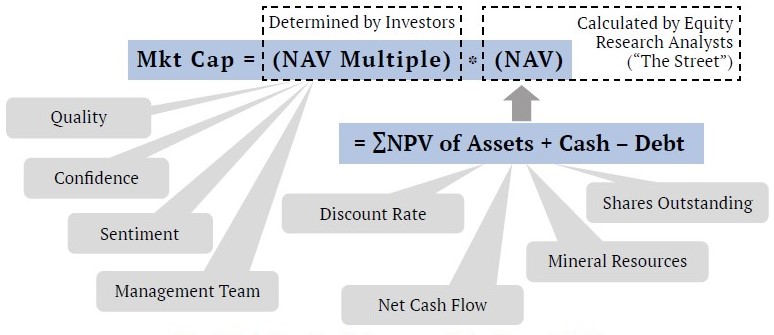

To reflect the industry practice of using “standardized” discount rates in mining Feasibility studies for non-producing projects, mining analysts use an adjustment to NPV (or more precisely Net Assеt value, of which NPV is the largest element). Fig. 2 provides an example of such conversion of NPV (or Technical Value) to the market value measured by market capitalization of a mining company, as presented by SRK [16].

Fig. 2. Relationships between market value and NPV

BMO [17] describes the use of P/NAV multiple by analysis as follows “We apply NAV target multiples to each asset in our coverage universe based on our assessment of the asset’s risk, including construction/startup risk, production risk, geopolitical risk etc. We also consider opportunities, including potential for mine life extension. The multiples that we have applied range from 0.0 and 0.1x for early-stage, end-of-life, or otherwise higher-risk assets, and 1.0x for mature and stable operating mines as well as long-lived smelter assets.”

There is a practical problem with using P/NAV multiple to estimate the market value – its calculation is not transparent, and it is not obtained directly from the market. Furthermore, it is an ‘integral’ adjustment to NPV, not to its two key parameters, i.e. cash flows and discount rate.

Feasibility studies often report NPV for a base case scenario, which may not and often does not necessarily meet the definition of the expected cash flows for a project that has yet to be built and is not producing. This is evidenced by the absence of probabilistic adjustments in NPV developed for PEA, PFS and FS studies.

Some analysts compensate for the higher risks of the cash flows by using a higher discount rate, assuming that above-average risks require above-average discount rates, other things equal. While intuitively appealing, this adjustment is highly subjective and lacks academic support to sanity check the size of the adjustment.

The NPV presented in PEA, PFS, or FS is usually calculated using a “standard” normative discount rate that doesn’t reflect the condition and risks of the project. There may be some logic in using 5% real discount rate for producing gold mine, but it is hardly appropriate for a company that is yet to start building a mine.

Early-stage mining projects, prospecting and early exploration phases, are known to have the highest levels of uncertainty and the lowest amounts of information. Acknowledging there is no way of reliably estimating the value of such a project, investors choose to defer the valuation decision until additional data is obtained. A typical way of investing in early-stage projects is to share risks (costs) and secure the right to commence a more reliable valuation in the future by signing an option or a farm-in agreement. No mining valuation code recommends using NPV for projects at this stage of development.

Producing mines with stable mining and sales volumes or large multi-location companies are valued by market participants based on their projected cash flows or market multiples of publicly traded peers; however, the uniqueness of every mine and the relatively small size of the mining equity markets constrain the reliability of comparison. The most challenging task is usually the valuation of PFS or FS stage projects prior to mine construction and production.

Estimating the market value of projects and companies that did not start mine construction and production

The probability of entering production and reaching the expected mining volumes can be accounted for in the cash flows, the discount rate, or both. Alternatively, it can be addressed by using an integral adjustment, such as the previously mentioned P/NAV.

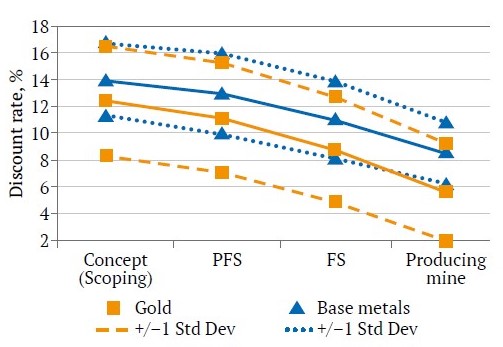

NPV of a gold mining project calculated in a Feasibility Study most often uses a ‘base’ real discount rate of 5% (equivalent to 7% in nominal terms, accounting for inflation). Lawrence Devon Smith [18] provided results of industry practitioners surveys undertaken over several years by CIM Mineral Economics Section to obtain an indication of common practice regarding discount rates for projects at different stages (Fig. 3). Respondents were asked to express the discount rates in real terms. Solid lines are mathematical averages of the responses; dashed lines indicate the ranges plus/minus one standard deviation. It is worth mentioning that the ranges are rather broad.

Fig. 3. Discount rates for cash flows in real terms for mining projects at differ stages

The publication also provided the average premiums over the ‘base’ discount rate, WACC for a producing mine, applicable for projects at different stages of development. We show them in Table 5.

Table 5

Premiums over the “base” discount rate for projects at different stages

Premium above WACC of a producing mine, % | FS | PFS | PEA/Scoping |

Gold | 3.3 | 5.7 | 6.9 |

Base metals | 2.5 | 4.5 | 5.5 |

The survey results demonstrate the inverse relationship between project risk and discount rates used by market participants.

A. Davis [19] criticized the practice of using the discount rate as a receptacle of all and any risks. It is more appropriate to model the uncertainties of a specific project directly in the cash flows, not grossing up the discount rate with “specific” premiums lacking theoretical rigor and practical ways of calibrating them to risks.

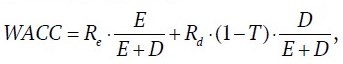

The basic formula for the weighted average cost of capital or WACC is as follows:

where Re – cost of equity capital; E/(E + D) – share of equity in capital; Rd – cost of debt; D/(E + D)– share of debt in capital; T – corporate tax rate.

To estimate the cost of equity of smaller companies, the modified CAPM model is often used.

Re = (Rf + CRP) + β × ERP + SP,

where Rf – risk-free rate; CRP – country risk premium; β (Beta) – the coefficient that reflects the relationship between the asset risk and market risk; ERP – average equity risk premium over and above the risk-free rate; SP (size premium) – premium for smaller sized companies.

The following calculations illustrate how NPV would change for a Twin Hills project, developed by Osino Resources in Namibia, using the same cash flows assumptions, but selecting a different discount rate based on the modified CAPM.

The calculations are as of June 2023, the date of Osino Resources’ technical report, an FS prepared in accordance with NI43-101 (the company used the name DFS, Definitive Feasibility Study) [20]. DFS includes the details of the NPV calculations made in real terms assuming long-term gold price of USD1,750/oz and a discount rate of 5% resulting in NPV of USD 480 million. The company also illustrated the sensitivity of NPV to gold price, showing that at a gold price of USD1,950/oz, the project’s NPV would be USD656 million. In June 2023, spot gold prices ranged from USD1,910 to 1,970/oz. The consensus forecast predicted a gold price of USD1,500/oz

in 5–7 years.

The assumptions we made in developing the discount rate were as follows:

Rf – considering the cash flow forecasts in the DFS were in USD, the risk-free rate was the yield of 10Y US treasury bonds of 3.7%.

CRP – country risk premium can be proxied by the spread between the US T-bonds and the project’s country Eurobonds (if available) or a country with the same credit rating. According to Professor Damodaran, Namibia's country premium was 5.5% in 2023.

ERP – equity risk premium, Rm–Rf, (Equity Risk Premium, «ERP») is the difference between the expected returns on a diversified portfolio of stocks and the risk-free rate. It can be interpreted as the average premium investors require for investing in stocks as an asset class. According to Kroll, mid-year 2023 ERP was 5.5%.

Beta – the coefficient showing the riskiness of the stock (or industry) relative to the market. To address the fact that companies’ Betas can be noisy, practitioners often use average betas for a representative peer group of companies from the same industry. The mining companies’ industry beta reported by Professor Damodaran was 1.17. It should be noted that this average beta was developed using the industrywide set of companies that include the large gold miners with betas well below one and junior gold mining companies with projects at the exploration stage that have significantly higher betas.

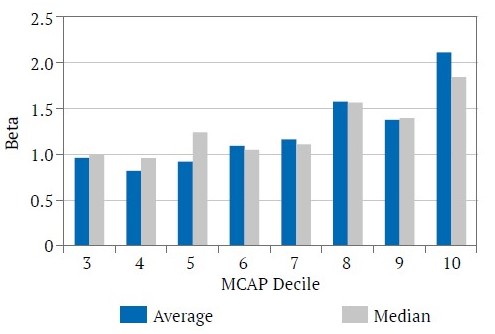

It is empirically established that betas tend to increase as company size goes down, the relationship holds for all industries. Our analysis of junior gold mining companies shows that their Betas start increasing significantly for companies in the 8–10th size deciles, those with market capitalization of below USD 1 billion. We show it in Fig. 4. The below trend betas for the companies from decile 9 are reflective of the composition of the decile that includes companies with operating mines, hence lower risks.

Fig. 4. Betas for different size deciles of junior gold mining companies

The average Beta for the set of junior gold mining companies from the 9th and 10th deciles was 1.5.

SP – size premium is the incremental return expected by investors in smaller-sized companies over and above the Beta of the stock.

Non-producing public junior gold mining companies have market capitalization below USD 500 million and are classified as microcapitalization stocks. Size premium for the companies of this size is estimated by Kroll as 2.9%. For smaller companies with a market capitalization below USD200 million, it is 4.7%.

Considering the above, the cost of equity for Osino Resources can be estimated as follows:

Re = 3.7%+5.5%+1.5∙5.5%+2.9% = 20.4%.

Using industry average capital structure and Osino Resources’ cost of debt, the company’s WACC is estimated to be approximately 18% in nominal terms, or 16% in real terms. The calculated discount rate is significantly higher than real 5% rate selected in the DFS NPV calculations.

Using a 16% real rate developed using the modified CAPM with size premium adjustment and a cash flows probability adjustment of 88% for projects at FS stage, the resulting NPV would be USD150 million.

In June 2023, at the time when Twin Hill project DFS was published, base case NPV@5% in the technical report was USD464 million, whereas the market capitalization of the company was USD134 million, or about 30% of the reported NPV. Considering total resources of the project of 3.19 million oz of gold and the company’s enterprise value (EV) of USD132 million, the market valued Osino Resources at USD42/oz.

The market valuation was also closer to the Rule of Thumb (or Yardstick Metod) estimate of USD129–172 million. This empirical method uses market transactions data for gold companies and projects and usually works best for earlier stage resources projects but can also be used to test the reasonableness of NPV for non-producing mining projects that did not start mine construction. [21, 22]

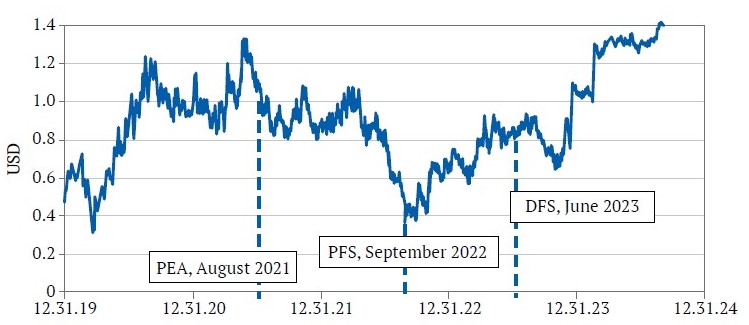

Fig. 5 shows the dynamics of the company’s market capitalization. The dashed lines indicate the dates Osino Resources published PEA (August 2021), PFS (September 2022), and DFS (June 2023).

Fig. 5. Osino Resources share price, USD

The chart shows that the publication of the DFS did not materially change the market’s opinion regarding the value of the Twin Hills project. This is not unusual assuming the typical value evolution profile for the mining companies known as the Lassonde Curve [23]. During the so-called ‘orphan’ period — when there is no investor committed to finance and develop the project, or until such a decision is made by the current owner — the value of a project often declines.

In December 2023, six months after the DFS was published, Dundee Precious Metals offered USD214 million to buy Osino Resources, the owner of the Twin Hill project, at a premium of 44.3% to Osino Resources’ market capitalization. [24] In February 2024, Chinese Shanjin International Gold Co., Ltd. (previously Yintai Gold Co., Ltd.) made a better offer and acquired the project for USD272 million [25]. Following the acquisition, the buyer delisted Osino Resources from the TSX.

Despite a competitive bid and a high premium, the acquisition price was significantly lower than the DFS NPV, representing only about 60% of the reported value.

Discussion and Conclusions

The analysis of Feasibility Study level non-producing mining projects helps understand the reasons behind the systematic difference between NPV in technical reports and the market value of mining companies measured as their market capitalization.

Industry professionals and companies providing disclosure to investors have to better explain the differences in two value metrics, i.e. NPV and market value, since not all the users of such reports are equally experienced and knowledgeable about the peculiarities of the mining industry, and may therefore interpret them incorrectly. Market capitalization of a company and the volatility of its stock price provide important information about its market value and risks at different stages of project development.

The proposed method of estimating the market value of a non-producing company or project with completed PFS or FS but before the FID or construction of the mine considers the project’s risks and improves the reliability of the estimate. We showed that despite mining industry specifics, the use of expected cash flows and traditional methods for selecting discount rates (CAPM) when calculating NPV results in an adequate estimate of the project’s value that reasonably compares with the market analysis using a peer group.

Important note: these discount rates should be used with the expected cash flows. Feasibility Study resource projects and earlier stage PEA and Pre-Feasibility Study projects require the application of risk-adjusted cash flows that account for the probability of achieving production.

The Rule of Thumb method can reasonably estimate market value and test NPV for early-stage projects.

References

1. JORC. JORC Code: Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (Draft for Public Comment, 1 August 2024). URL: https://www.jorc.org/docs/Draft_JORC_Code_01Aug2024_readonly.pdf

2. Samis M., Martinez L., Davis G. A., Whyte J. B. Using dynamic DCF and real option methods for economic analysis in NI43-101 technical reports. URL: https://inside.mines.edu/~gdavis/Papers/ValMin.pdf

3. Samis M. Exploration value differentials. Understanding the value differential attached to early-stage exploration projects. Presented at: IMVAL: Perspectives on Mineral Valuation; 2021 May 13. URL: https://imval.org/uploads/presentation/2021-05-13/Slides/IMVAL_May2021_Samis-Slides.pdf

4. Ovalle A. Analysis of the discount rate for mining projects. In: Castro R., Báez F., Suzuki K. (eds.) MassMin 2020: Proceedings of the Eighth International Conference & Exhibition. Mass Mining, University of Chile, Santiago, 2020. Pp. 1048–1064. https://doi.org/10.36487/ACG_repo/2063_76

5. TriStar Gold Updates Economics of PFS with After-Tax 40% IRR and US$603 Million NPV5 and Provides Update on Permit. URL: https://finance.yahoo.com/news/tristar-gold-updates-economics-pfs-110000667.html

6. Frontier Lithium Inc. Corporate Presentation: Building North America’s highest quality source of lithium. URL: https://www.frontierlithium.com/_files/ugd/dec7de_bb60250af14744c9b41b6b36c3890d26.pdf

7. Dixit A. K., Pindyck R. S. Investment under uncertainty. Princeton University Press; 1994.

8. Categories of Mineral Properties. In: The CIMVAL Code for the Valuation of Mineral Properties. Prepared by the Special Committee of the Canadian Institute of Mining, Metallurgy and Petroleum on the Valuation of Mineral Properties (CIMVAL).

9. Sykes J. P., Trench A. Resources versus reserves – towards a systems-based understanding of exploration and mine project development and the role of the mining geologist. In: Ninth International Mining Geology Conference. Adelaide, SA, 18–20 August 2014. https://doi.org/10.13140/RG.2.1.5083.5600

10. McCarthy P. Why feasibility studies fail. URL: https://www.amcconsultants.com/experience/why-feasibility-studies-fail

11. Dussud M., Kudar G., Lounsbury P., et al. Optimizing mining feasibility studies: The $100 billion opportunity. URL: https://www.mckinsey.com/industries/metals-and-mining/our-insights/optimizing-mining-feasibility-studies-the-100-billion-opportunity#/

12. Méndez M. Real options valuations of the license of a copper mine. In: FFM 2011. (Revised September 2013). ESIC Business and Marketing School, Madrid, Spain. http://dx.doi.org/10.2139/ssrn.2708352

13. Bruce P. F., Clarke D. E., Bucknell W. R. The company perspective on valuation methods for exploration properties. In: Mineral Valuation Methodologies Conference. Sydney. 27–28 October 1994

14. West Red Lake Gold shares jump on Madsen restart. URL: https://www.mining.com/west-red-lake-gold-shares-jump-on-madsen-restart/

15. International Valuation Standards Council. IVS 104: Bases of value. Para 30.5. In: International Valuation Standards. 2022.

16. Robson D. M. What does it mean to create value in the mining industry? CIM MES Discussion Group, Toronto. January 31, 2018. URL:

17. Initiating at outperform (speculative): where does the value go? Turquoise Hill Resources, BMO Capital Markets. January 4, 2021. P. 35.

18. Smith L. D. Mineral economics – risk adjusted cash flows: discount rates. Risk & Long-Life Projects; 2013.

19. Davis G. A., (Mis)Use of Monte Carlo simulations in NPV analysis. Mining Engineering. 1995;47(2):75–79.

20. Armstrong R., Aucamp P.-J., Doundarov G., et al. Definitive feasibility study of the Twin Hills Gold Project, Namibia. National Instrument 43-101 Technical Report. URL: https://osinoresources.com/wp-content/uploads/2023/07/Osino-DFS.pdf

21. Roscoe W. E. Metal transaction ratio analysis – a market approach for valuation of non-producing properties with mineral resources. In: VALMIN Seminar Series 2011–2012. Perth, Western Australia, 18 October 2011. 17 April 2012, Brisbane, Queensland. The Australasian Institute of Mining and Metallurgy; 2012.

22. Araujo C. P. Valuation of mineral and coal assets. Presented at: SMEDGE Conference. 24 January, 2019.

23. The Lassonde curve – understanding the mining life cycle. SmallCapInvestor; 2023. URL: https://smallcapinvestor.ca/the-lassonde-curve-understanding-the-mining-life-cycle/

24. Dundee to acquire Osino in $214m deal. Mining Technology; 2023. URL: https://www.mining-technology.com/news/dundee-acquire-osino-214m-deal/

25. Yintai to acquire Osino Resources in $272m deal. Mining Technology; 2024 URL: https://www.mining-technology.com/news/yintai-osino-resources/

About the Authors

A. N. LopatnikovRussian Federation

Alexander N. Lopatnikov – Managing Partner

Moscow

A. Yu. Rumyantsev

Russian Federation

Alexander Yu. Rumyantsev – CFA, Director of Financial Analysis and Valuation

Moscow

Review

For citations:

Lopatnikov A.N., Rumyantsev A.Yu. Valuation of non-producing mining companies. Mining Science and Technology (Russia). 2025;10(3):306-316. https://doi.org/10.17073/2500-0632-2025-06-426