Scroll to:

Economic incentive instruments for the development of technogenic deposits

https://doi.org/10.17073/2500-0632-2024-09-255

Abstract

Russia possesses a significant but underutilized technogenic mineral potential, the development of which could expand the country’s mineral resource base and reduce environmental pressure. The aim of this study is to develop an effective economic mechanism – including instruments suitable for small businesses – to stimulate investment in the development of technogenic deposits. The study analyzes existing economic instruments for incentivizing the processing of technogenic mineral accumulations (TMA), proposes a methodological approach for selecting the optimal set of instruments, and presents an integrated economic model. Special attention is given to a project prioritization system based on three key criteria: budgetary efficiency, economic efficiency, and environmental efficiency. For different project categories (green, yellow, red), the most effective instruments were identified, including tax incentives, state guarantees, and credit mechanisms. The proposed model of the economic mechanism is built on six fundamental principles: clarity, transparency, teamwork, modularity, controllability, and efficiency. The implementation of the proposed measures is expected to stimulate small business involvement in the development of technogenic deposits.

Keywords

For citations:

Yurak V.V., Ignatyeva M.N., Komarova O.G. Economic incentive instruments for the development of technogenic deposits. Mining Science and Technology (Russia). 2025;10(2):180-200. https://doi.org/10.17073/2500-0632-2024-09-255

Economic incentive instruments for the development of technogenic deposits

Introduction

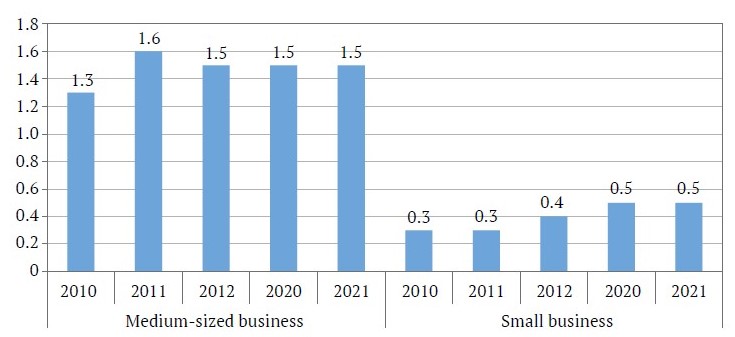

According to economic theory, small and medium-sized enterprises (SMEs) are the driving force behind the development of any national economy [1, 2]. However, the criteria for classifying businesses as small or medium vary across countries, as noted by D. A. Pletnev, V. I. Barkhatov, and K. A. Naumova1. In Russia, such classification is based on annual revenue and average headcount, which are used to distinguish micro, small, and medium-sized enterprises (hereinafter collectively referred to as “small enterprises” or SEs). It has been demonstrated that SEs serve as a foundation for the formation of the middle class and are a key factor in stabilizing and minimizing social tension, as they create jobs for the local population [3]. The mining sector is no exception [4, 5]. In recent years, amid the growing relevance of the circular economy concept, increasing geological complexity of developing new mineral deposits, and depletion of the country’s mineral resource base – particularly in terms of processing technogenic mineral accumulations, including small placer deposits (in this case, the focus is on the industrial and consumer waste management sector) – a noticeable upward trend has emerged [6, 7]. The main areas of activity for such small-scale subsoil users include the recovery of valuable components from industrial and consumer waste, as well as the improvement and development of new technologies for processing such waste [8]. This trend is characteristic not only of Russia, but also of Western countries. However, while abroad the share of small-scale subsoil users among all SEs ranges between 15 and 30%, in Russia this figure remained between 0.3% and 1.6% over the period from 2010 to 2021 [9] (Fig. 1).

Fig. 1. Share of subsoil users among SMEs in the Russian Federation, %

Source: compiled by the authors based on: Nadymov D. S. Development of an organizational and economic mechanism for the development of technogenic deposits using state development instruments. [Diss. ... Cand. Sci. (Econ.)] St. Petersburg; 2015. 157 p.; Small and Medium-Sized Enterprises in Russia. Statistical Yearbook. Rosstat. Moscow; 2022. 101 p.

Fig. 1 shows the relative stability in the number of small and medium-sized enterprises operating in the mining and metallurgical sector over the past decade. Nevertheless, a modest but notable increase can be observed in the number of small businesses specifically involved in resource development, with their share rising from 0.3% to 0.5%. A more detailed analysis of these figures reveals that this growth was driven primarily by enterprises engaged in the oil industry, as opposed to the mineral (ore) sector [10, 11], not to mention innovative startups focused on waste processing. Unfortunately, even among these oil-related enterprises, the majority operate at a loss2 [12]. All of this points to a range of persistent challenges in the development of small and medium-sized enterprises in the field of resource development and the processing of industrial and municipal waste. One of the fundamental problems, from the standpoint of resource-use economics, is the inadequacy of the existing economic regulation mechanism that governs this area of activity.

1 Pletnev D., Barkhatov V., Naumova K. SME’s Criteria in National Economies and Its Scale: A Comparative Study. 2021. URL: https://www.researchgate.net/publication/355331587_SME's_Criteria_in_National_Economies_and_Its_Scale_A_Comparative_Study

2 Small and Medium-Sized Enterprises in Russia. 2013: Statistical Yearbook. Rosstat. Moscow; 2013. 127 p.

Review of regulatory frameworks for the management of technogenic mineral accumulations: Russian and international experience

The lack of incentives for activities related to the management of industrial and consumer waste is reflected in the rather fragmented guidance provided in official policy documents such as the “Foundations of the State Policy in the Field of Environmental Development of the Russian Federation for the Period up to 2030” (approved by the President of the Russian Federation on April 30, 2012) and the “Environmental Doctrine of the Russian Federation”. These documents limit the promotion of technogenic mineral object processing to secondary processing of industrial waste, focusing on waste collection, sorting, and subsequent use as secondary raw materials and energy sources. As a result, resource conservation is prioritized, while the environmental consequences are largely overlooked. This approach aligns with the concept of a circular economy, which emphasizes the reuse of resources, but neglects key aspects of environmental sustainability, such as pollution reduction and biodiversity conservation3. Thus, the existing system of incentives is narrowly focused on the economic efficiency of waste processing, while disregarding broader environmental imperatives recognized in international agreements and national development strategies.

Policy documents, legislative acts, and conference recommendations addressing the use of technogenic mineral accumulations repeatedly emphasize the need to develop and implement mechanisms for economically incentivizing their processing4. In particular, regional sustainable development strategies consistently highlight the importance of creating economic stimuli for enterprises engaged in the processing of mining and metallurgical industry waste. The legislation governing the management of industrial and consumer waste also provides for the possibility of granting tax incentives and subsidies to organizations involved in the processing of technogenic mineral resources5. The outcomes of scientific conferences and expert discussions confirm that an effective system of economic incentives is a key factor in increasing the profitability and scalability of technogenic mineral accumulation (TMA) processing, which in turn contributes to reducing environmental impacts and promoting the rational use of natural resources. For example, in the recommendations of the 2013 All-Russian Conference, it was proposed that federal legislative and executive authorities should:

- implement a set of measures to economically incentivize the rational use of waste;

- include waste disposal facilities from mining and related processing industries in the list of facilities eligible for public-private partnership (PPP) agreements [13].

As part of the Strategy’s implementation6, lawmakers emphasize the importance of incorporating the use of economic and administrative instruments for waste management into the list of fundamental principles, as well as promoting the active use of PPP mechanisms at the stage of waste generation7. Key areas recognized as crucial for attracting investment in the development of technogenic deposits include the formulation of economic regulatory instruments to support sectoral growth and the introduction of incentives for stakeholders and enterprises engaged in waste processing – such as tax benefits and preferential treatment. These measures are intended to create favorable conditions for the development of processing infrastructure and to improve the investment attractiveness of projects in the waste management sector.

During the Soviet era, the issue of economic incentives for the use of by-products and production waste was also a subject of considerable attention. The main objective of incentive measures was to motivate enterprises to engage in activities aimed at reducing resource consumption and improving the environmental safety of production processes8, specifically:

- rational use of mineral resources;

- more complete extraction and utilization of associated minerals, overburden, host rocks, and primary processing waste;

- prevention of environmental pollution;

- minimizing land withdrawal for the storage of by-products and waste”9.

A broad set of mechanisms was historically employed to promote waste utilization, including price regulation, strategies for integrating secondary raw materials into the economic cycle, and the establishment and distribution of material incentive funds for employees involved in waste processing. The utilization process was largely governed by directive management methods typical of a centrally planned economy.

The resolution of the CPSU Central Committee and the Government of the USSR dated January 7, 1988, “On a Fundamental Restructuring of Environmental Protection in the Country” is considered the first attempt to introduce economic instruments into environmental management. This document emphasized the priority of using economic methods in the regulation and governance of natural resource use and environmental protection. The first legal codification of economic instruments for regulating waste-related activities appeared in Section III of the RSFSR Law “On Environmental Protection”, which introduced payments for negative environmental impact, including fees for the disposal of industrial and consumer waste. This section also outlined the procedures for financing targeted environmental programs implemented at various levels of government – from regional to federal10. These measures were intended to encourage environmental protection activities and reduce anthropogenic pressure on ecosystems. However, according to most experts, these initiatives were not sufficiently developed and did not fulfill their intended role. With the transition to a market economy, emphasis shifted to other economic levers, such as taxation, monetary policy, and related financial instruments11 [14]. Overall, the situation has remained largely unchanged. Amendments to the Federal Law “On Industrial and Consumer Waste” and the Federal Law “On Environmental Protection” have been widely regarded by experts as ineffective, as these revisions do not constitute direct-action norms and thus require the subsequent adoption of additional subordinate legislation12 [15].

The current economic mechanism for waste utilization is widely characterized as ineffective [16, 17]. Elements of economic incentives in the existing legislation are fragmented and lack coherence, as evidenced by the predominance of declarative provisions that have not been followed by practical implementation13 [18]. Relevant authorities, such as the State Duma Committee on Natural Resources and the Ministry of Natural Resources and Environment of the Russian Federation, have failed to fulfill their responsibilities in improving the legal framework for incentivizing activities related to the management of industrial and consumer waste and the remediation of historical environmental damage [19]. As a result, appropriate federal legislation in this area has yet to be enacted [20], which hinders the formation of an effective waste management system and delays the creation of incentives necessary for the development of this sector.

It is also regrettable that Federal Law No. 209-FZ “On the Development of Small and Medium-Sized Enterprises in the Russian Federation”, adopted on July 24, 2007, explicitly excludes SMEs engaged in subsoil use, including the development of technogenic mineral accumulations, from the list of entities eligible for state benefits and preferences. Furthermore, under the provisions of Federal Law No. 224-FZ of July 13, 2015 “On Public-Private Partnerships, Municipal-Private Partnerships in the Russian Federation, and Amendments to Certain Legislative Acts of the Russian Federation”, small enterprises are excluded from the list of entities authorized to enter into public-private partnership (PPP) agreements. This legislative restriction deprives SMEs of the opportunity to participate in PPP projects and limits their access to financial support from development institutions established to promote economic growth and innovation. In turn, this may constrain competition in the PPP sector and reduce the involvement of small businesses in projects of significant socio-economic importance.

Under such conditions, it is only natural to turn to international experience in applying market-based economic instruments to stimulate the processing of technogenic mineral accumulations. However, it is important to adopt the best practices of industrially developed countries in a balanced and thoughtful manner, rather than through blind replication.

The efficiency of economic instruments used in these countries to promote waste processing can be evaluated based on statistical data. For instance, due to the implementation of advanced technological solutions, over 40% of the annual copper output, 35% of gold, and significant portions of other strategically important metals in foreign countries are obtained from secondary raw materials. According to researchers, this share continues to grow and, in some cases, exceeds the volume extracted from primary raw materials. At the same time, the cost of metal recovery is reduced by a factor of 1.5 to 3.0 [21, 22]. In the material flow balances of the United States and Japan, secondary raw materials account for up to 26% of input resources. In most developed economies, the contribution of recycled materials ranges from 16 to 20%. These figures reflect the growing importance of recycling in meeting industrial needs and reducing dependence on primary raw material sources [23]. According to V. V. Chainikov, the recycling rates of ash and slag dumps are as follows: 53% in the United Kingdom, 65% in France, 75% in Germany, and 25% in the United States. The recycling of blast furnace slag reaches up to 100% in Germany, the United States, and the United Kingdom, and up to 90% in France [24]. The recycling rate of steelmaking slag is 55% in Japan and up to 35% in the United States [25]. The experience of government support for entrepreneurial activity that has yielded significant results in the field of advanced waste processing and disposal deserves unequivocal recognition. For example, Germany – previously mentioned – offers a wide range of economic incentives, including free access to information on waste and recycling technologies, along with active use of specialized exchanges and auctions [26]. In the United States, economic instruments include subsidies, tax incentives, loans, investment tax credits, and more [27].

Some countries also employ direct public investment in industrial and consumer waste management. For instance, under the condition of applying advanced technologies, entrepreneurs in Sweden can receive direct subsidies covering up to 50% of the costs of constructing or upgrading their waste recycling facilities. The German model, similar to that of Sweden, focuses on implementing zero-waste technological processes [28]. In Japan, the government funds centralized research projects dedicated to developing waste utilization methods. Japanese entrepreneurs engaged in waste recycling also benefit from a special depreciation system for writing off environmental equipment and enjoy local tax exemptions. In addition, such enterprises can obtain concessional loans from specialized banks and funds at reduced interest rates. Similar mechanisms operate in Germany, where the national development bank provides targeted loans for waste recycling and processing projects. If a project involves recycling waste from multiple industrial sectors, entrepreneurs may apply for funding from specialized regional foundations. All these economic instruments are aimed at creating conditions in which recycling becomes more profitable for entrepreneurs than paying levies and fines for landfilling, storing, or incinerating waste. Moreover, foreign countries have developed not only economic but also legal mechanisms to promote waste recycling. As early as the late 20th century, countries such as Austria and Germany enacted dedicated legislative acts – namely, the “Circular Economy and Waste Act” (Germany) and the “Packaging Decree” (Austria). These legal frameworks are designed to assign producers full responsibility for their products across the entire life cycle. The implementation of these provisions has led to a measurable reduction in both total waste volumes and the amount of unprocessed packaging. In Austria, for instance, this approach yielded substantial results: over a ten-year period, the total volume of waste and packaging was reduced threefold, while some waste categories saw a 30- to 40-fold decrease [28]. These outcomes clearly demonstrate the effectiveness of the extended producer responsibility concept in tackling waste management and environmental protection challenges.

The organizational framework has also been adjusted to intensify waste recycling activities, with dedicated institutions established in various countries. For example, in Japan, responsibility for waste management lies with the Ministry of Economy, Trade and Industry (METI). A key component of this system is the Clean Japan Center, which operates under METI. The center coordinates the efforts of businesses, non-profit organizations, and government agencies involved in the collection and recycling of industrial and municipal waste. It also conducts expert evaluations of emerging technologies and supports local authorities in developing waste recycling systems. In addition, the center maintains a specialized database of waste recycling technologies applied in Japan and abroad14. In the United States, a specialized agency within the Department of the Interior is responsible for the reclamation of mine sites and the enforcement of the Surface Mining Control and Reclamation Act15. In France, issues related to waste recovery and recycling are addressed through joint efforts by national and regional agencies for ecological transition16 (Agence de la transition écologique, 2024) [29]. In the Russian Federation, despite the urgency of the waste problem, the sector remains outside centralized state regulation [30, 31].

Given the specific features of the economic regulatory framework for subsoil use – particularly in relation to technogenic mineral accumulations (TMAs) – there is a clear need to develop a more effective set of economic instruments, including those applicable to small enterprises, to stimulate investment in the development of technogenic deposits. This objective shaped the following research tasks: (1) to review existing economic instruments that support TMA processing; (2) to develop an original methodological approach for identifying the optimal set of instruments for technogenic deposit development; and (3) to propose a comprehensive model of an economic mechanism that incentivizes TMA processing.

3 UNEP (2011). Towards a Green Economy: Pathways to Sustainable Development and Poverty Eradication. United Nations Environment Programme.

4 Regional Target Program “Processing of Technogenic Formations of Sverdlovsk Region”. 1996; Republican Target Program “Ecology and Natural Resources of the Republic of Bashkortostan (for 2004–2010 and the period until 2015)”. Ufa; 2004; Federal Target Program “Waste”. Moscow; 1996.

5 Federal Law “On Industrial and Consumer Waste” No. 89-FZ of June 24, 1998.

6 Strategy for the Development of the Industry for the Treatment, Recycling, and Neutralization of Industrial and Consumer Waste for the Period up to 2030. Order No. 84-r dated January 25, 2018. Moscow, 2018.

7 Federal Law “O Industrial and Consumer Waste” No. 89-FZ.

8 Resolution of the Council of Ministers of the USSR No. 65 of January 25, 1980 “On Measures to Further Improve the Use of Secondary Raw Materials in the National Economy”; Resolution of the Council of Ministers of the RSFSR No. 237 of May 7, 1980 “On Measures to Further Improve the Use of Secondary Raw Materials in the National Economy of the RSFSR”.

9 Methodological Recommendations for the Economic Stimulation of the Comprehensive Use of Associated Raw Materials and Processing Waste. Donetsk: Institute of Economic and Industrial Research, Academy of Sciences of the Ukrainian SSR; 1986. 46 p. P. 5.

10 Law of the RSFSR No. 2060-1 of December 19, 1991, “On Environmental Protection”.

11 Belik I.S. Economic Mechanism for Incentivizing the Use of Industrial Waste. [Abstr. Cand. Sci. (Eng.) Diss.] Yekaterinburg; 1993. 24 p.

12 Yastrebkova O.A. Organizational and Legal Issues in Environmental Protection from Pollution by Mining and Related Processing Industry Waste. [Diss. ... Cand. Sci. (Law)] Yekaterinburg; 2000. 189 p.

13 Seleznev S.G. Waste Dumps of the Allarechensky Sulfide Copper-Nickel Ore Deposit: Specific Features and Development Challenges. [Diss. ... Cand. Sci. (Geol.&Min.)] Yekaterinburg; 2013. 141 p.

14 Ministry of Economy, Trade and Industry, Japan, 2025. URL: https://www.meti.go.jp/english/

15 Office of Surface Mining Reclamation and Enforcement, 2025. URL: https://www.osmre.gov/

16 Agence de la transition écologique, 2024. URL: https://www.ademe.fr/

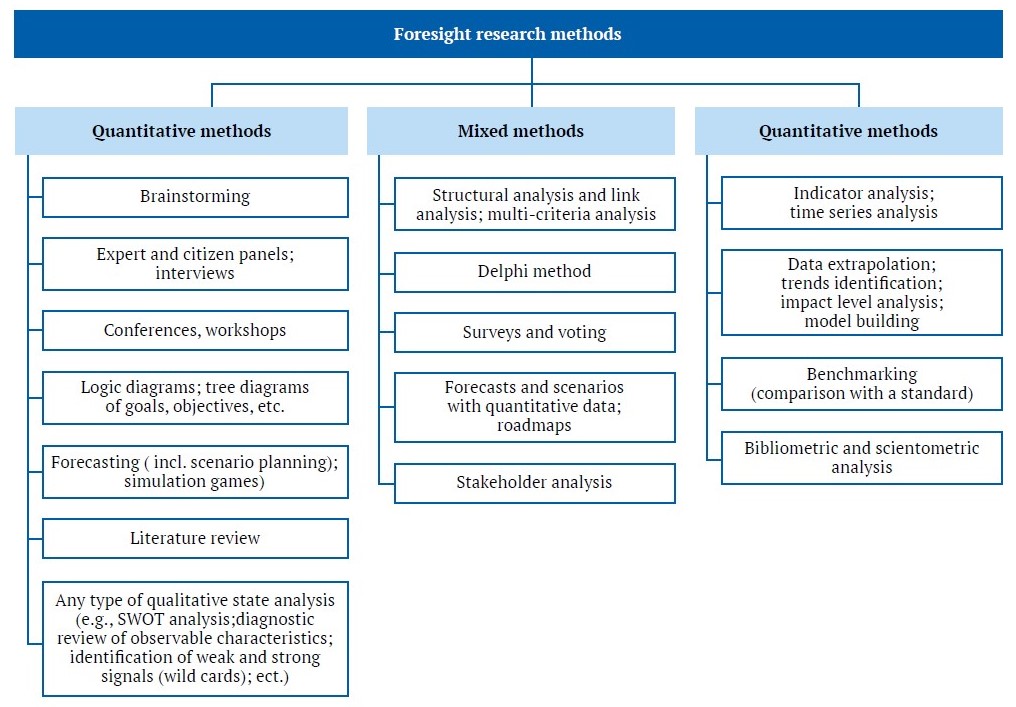

Methods

Methodological issues in the analysis of socioeconomic systems, including economic analysis, have been at the center of scholarly debate in recent years, as evidenced by numerous publications from the New Economic Association. Key works are featured on the website of the community of “scholar-economists from various academic schools and traditions across the Russian Federation”17, who argue that the social sciences are currently experiencing a methodological crisis. The study of socio-economic and human-centered systems – such as waste management regulation or subsoil use governance, which are the main research subjects of the present paper – requires a wide range of methodological tools. This toolkit includes not only methods of mathematical statistics and game theory, but also specific approaches for analyzing complex human-centered systems, such as foresight methods (from the English foresight, meaning to look ahead or anticipate the future). In the methodology proposed by Rafael Popper18 [32, 33] foresight methods are structured as a hierarchical system of specific research techniques (Fig. 2) employed in the course of scientific inquiry. These foresight methods are traditionally classified into three types: qualitative (methods aimed at subjective understanding and evaluation of research objects), quantitative (methods allowing for objective measurement of phenomena, followed by mathematical or statistical analysis), and mixed methods (which involve quantifying qualitative judgments, opinions, and expert or survey-based assessments).

Fig. 2. Hierarchical structure of foresight research methods

Source: compiled by the authors based on the works of R. Popper [32, 33].

One of the key advantages of the foresight methodology lies in its flexibility and methodological pluralism, enabling researchers to choose from a diverse set of tools based on the specific goals of the study and to validate results through various approaches. In this research, the following foresight methods were employed to develop the most effective set of economic incentives (including those accessible to small businesses) for encouraging investment in the development of technogenic mineral deposits: 1) to analyze the existing economic incentives aimed at promoting the processing of technogenic mineral accumulations (TMAs), qualitative methods were used, including a literature review and participation in thematic conferences and workshops; 2) to develop both an original methodological approach designed to justify and substantiate the optimal set of incentives for the development of technogenic deposits and a model of the economic mechanism for incentivizing the processing of technogenic mineral accumulations (TMAs), the full range of foresight methods was employed. These included qualitative techniques such as brainstorming sessions and expert workshops, the mixed Delphi method, and a quantitative approach involving modelling and scenario construction using hypothetical examples. It is worth noting that the model of the economic mechanism for incentivizing the processing of technogenic mineral accumulations (TMAs) – including for small enterprises – was developed based on the findings obtained through all of the aforementioned research methods. In particular, it incorporated insights from the literature review as well as participation in seminars and conferences.

17 New Economic Association. URL: https://econorus.org/sub.phtml?id=182

18 Rafael Popper. URL: https://scholar.google.co.uk/citations?user=Z5gep-0AAAAJ&hl=es

Results and discussion

Using a content analysis approach based on keywords such as “economic instruments,” “technogenic mineral accumulations (TMA),” “mining waste,” “small business,” “small enterprises,” “tax incentives,” and “public-private partnership (PPP),” approximately 50 academic publications were selected for review. The information base for this study included research by both Russian and international scholars, sourced from library collections and scientometric databases such as Scopus, Web of Science (via ResearchGate), and the eLibrary portal. This provided a structured foundation for developing the most effective set of economic instruments (including those relevant to small businesses) aimed at attracting investment in the development of technogenic deposits.

1. Overview of economic instruments that stimulate TMA processing

The core set of economic instruments that encourage TMA processing – applicable broadly, including to small businesses – can be summarized as follows: 1) corporate income tax; 2) mineral extraction tax (MET); 3) VAT; 4) one-time payments; 5) cost write-offs; 6) subsidies; 7) loans; 8) property tax; 9) municipal property lease payments; 10) credits; 11) PPP. It should be noted that the general list of economic instruments and the logic behind its construction do not depend on the size of the enterprise – whether small, medium, or large. However, the efficiency of these instruments may vary depending on company size. As mentioned earlier, the only significant distinction concerning small businesses lies in the inapplicability of PPP mechanisms, which currently require adjustments to the national regulatory framework. Otherwise, the full range of economic instruments remains identical. In the Russian Federation, the limited efficiency of existing economic incentives for waste recycling has led to increased research activity focused on modernizing these mechanisms. This, in turn, has generated numerous proposals for amendments to the legal framework. Most of these proposals focus on optimizing tax policy and the financial and credit system (see Table 1). Analysis of the available data highlights a particular emphasis on corporate income tax and MET. For example, it has been proposed to exempt from corporate income tax any profits derived from the sale of products made from technogenic raw materials. Some experts recommend granting this tax benefit for a period of 1.5 to 2 years for newly established small enterprises. Regarding the MET, opinions vary – from full cancellation to a reduction in tax rates or the application of lowering coefficients. Criticism of MET has repeatedly been voiced in policy recommendations submitted to governmental authorities. Nonetheless, none of these proposed amendments have been adopted to date. The fiscal nature of the current MET hinders the development of recycling activities. Thus, either a full repeal or a comprehensive revision of the tax calculation methodology is needed. Other proposals of interest include eliminating one-time payments and involving national development institutions in funding R&D activities in this area.

Table 1

Economic incentive instruments for TMA processing

| Authors | Economic instruments proposed by researchers |

| Nadymov D. S.19 | Deduction of geological exploration expenses from MET; Elimination of one-time payment |

| Chernyavsky A. G. [12] | Exemption from MET |

| Kubarev M. S., Ignatieva M. N. [16] | Exemption of marketable products derived from TMAs from income tax; Tax rate reduction or full exemption for 1.5–2 years upon introduction of new technologies; Full exemption for eco-friendly technologies (investment tax credit); Subsidies for clean tech development and interest payment on loans; Loans for installation of eco-tech equipment; Reduction or exemption of property tax; Reduction or exemption of municipal property lease fees; Concessional loans (guaranteed by regional government) |

| Kiperman Y. A., Komarov M. A. [30] | Exemption from income tax and MET |

| Seleznev S. G., Boltyrov V. B. [39] | Elimination of income tax |

| Mirzekhanov G. S. [40] | Reduction of taxable income base when purchasing new technological equipment; Elimination of MET; Deduction of exploration expenses for technogenic deposits |

| Boyarko G. Yu. [41] | 50% reduction of VAT rate |

| Klemez T. N. [42] | Use of environmental coefficients in MET calculation |

| Seleznyov S. G. [43] | Exemption from income tax and MET |

| Sukhoruchenkov A. I., Kornilov N. P., Evsin V. G. [44] | Income tax exemption on revenue allocated to advanced technologies; Reduction of MET rates |

| Ochilov S., Kadirov V., Umirzoqov A., Karamanov A., Xudayberganov S., Sobirov I. [45] | Deduction of exploration expenses for technogenic deposits (from tax base) |

| Machado C. [46] | Elimination of income tax; Concessional loans |

| Ignatyeva M. N., Yurak V. V., Dushin A. V., Strovsky V. E. [35] | Implementation of the PPP mechanism |

| Potravny I., Novoselov A., Novoselova I., Gassiy V., Nyamdorj D. [47] | Reduction of TMA exploration costs |

| Butkevich G. R. [48] | Subsidies for clean tech development; Loans for the installation of clean technologies; Concessional loans and state guarantees |

| Goldyrev V., Naumov V., Kovyrzina U. [49] | Reduction of TMA exploration costs |

Most research studies tend to focus on individual components of the economic mechanism. For instance, one study20 examines the optimization of the system of environmental impact fees. Another research21 analyzes the interaction between government agencies and oil and gas companies within the framework of public-private partnerships. A separate study22 explores the pricing methodology for by-products of industrial activity. In [34], the author evaluates the effectiveness of programs financed through earmarked funds, while study [35] investigates the potential of using PPPs as an economic policy instrument for regulating subsoil use, including by small enterprises.

Given the limited availability of financial resources, it is necessary to establish prioritization criteria when allocating state support. One possible approach, described in a separate study23, proposes classifying potential beneficiaries based on positive financial indicators and the volume of economic damage potentially avoided, and distributing funding proportionally to this value. In this model, the likelihood of receiving public funding is directly proportional to the scale of the anticipated avoided damage. In calculating avoided damage, a range of factors is taken into account, including losses resulting from land alienation, the negative effects of air, water, and soil pollution, and elevated risks to public health and mortality associated with environmental degradation.

The monetary valuation of land withdrawn from productive use serves as an indicator of the economic damage resulting from its requisition. The key methodological principles for assessing such damage are based on the following considerations: first, priority is given to the effective use of land assets; second, only losses related to the loss of the land’s functional capacity are considered; third, the temporal aspect must be accounted for, including changes in land value over time; and fourth, various valuation methods may be used, provided they comply with current legislation and regulatory standards.

Requisition may affect lands used for agriculture, forestry, and game management, as well as land within the boundaries of populated areas. Methodologies for assessing economic damage vary depending on the land category. In calculating the financial burden caused by the pollution of natural resources (ambient air, water bodies, and soil), the use of aggregated indicators is recommended. To estimate economic damage resulting from increased population morbidity, methodologies outlined in [36] may be applied. The adoption of the “avoided economic damage” principle as an evaluation criterion is motivated by the urgent need to improve environmental conditions in industrialized regions, which often exhibit significant accumulated damage and unfavorable environmental conditions [37]. The proposed recommendations were successfully tested in Sverdlovsk Region as part of the targeted program Processing of Technogenic Formations in Sverdlovsk Region (1996). However, the methodology does not take into account the economic effect or profitability of the investments implemented.

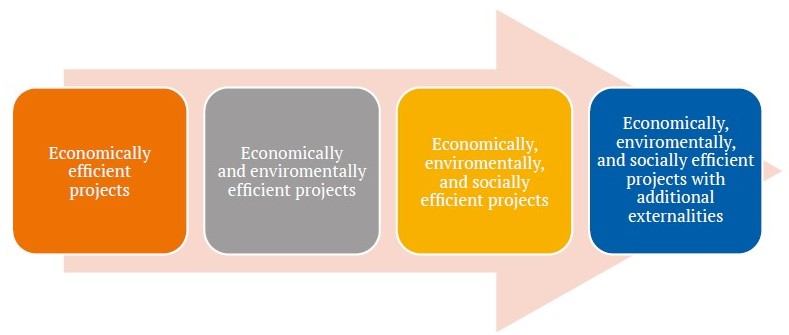

In study [38], the authors emphasize the importance of waste recycling from the perspectives of economic, environmental, and social efficiency, as well as the generation of positive externalities (Fig. 3).

Fig. 3. Classification of waste recycling projects by type of efficiency

Source: authors’ compilation based on data from [38].

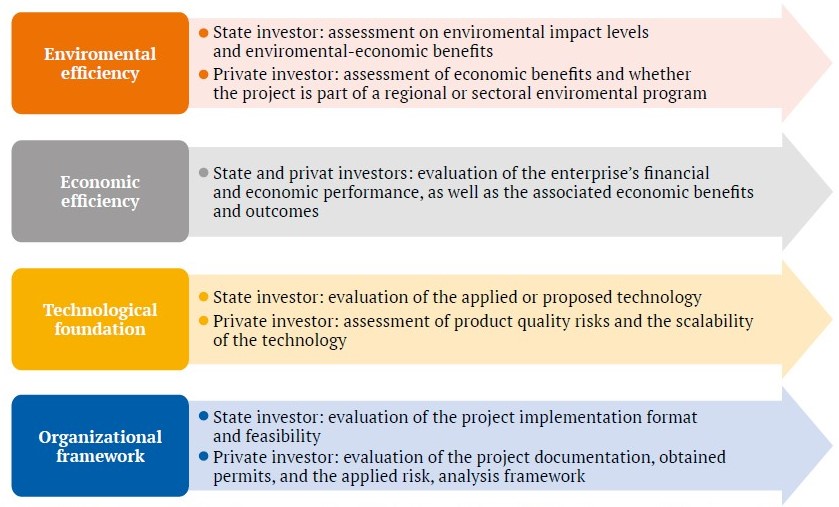

Fig. 4. Criteria for evaluating investment eligibility of projects for the development of technogenic deposits

Source: compiled by the authors based on the work by Mudretsov A. V. Economic Feasibility of Prioritizing Investment Projects for Mining Waste Recycling and Disposal. [Diss. ... Cand. Sci. (Econ.)] Moscow; 2003. 138 p.

To encourage secondary waste processing, the establishment of regional support funds is proposed. These funds would be financed through targeted contributions from profitable commercial ventures. Priority funding should be directed to projects that demonstrate both economic and environmental efficiency. Projects delivering economic, environmental, and social benefits should be supported not only through these targeted funds but also through employment assistance programs. Support for projects with cumulative effects and positive externalities is warranted when there is substantial potential to generate benefits in related sectors of the economy. Beyond measurable outcomes, project prioritization criteria should take into account regional characteristics and the broader implementation context. For instance, in regions with adverse environmental conditions, both economic efficiency and environmental impact must be considered in line with the United Nations’ sustainable development principles. In contrast, in areas where there is a risk of social tension, priority should be given to projects that generate social benefits from the development of technogenic deposits – even though such benefits are often difficult to quantify. Evaluating positive externalities – especially spillover effects in adjacent sectors – is even more challenging and resource-intensive. As a result, economic and environmental effciency are generally accepted as the primary evaluation criteria. This viewpoint is also presented in a study24, where the author suggests that, in addition to these core criteria, two more should be included when allocating resources to potential subsoil users – public or private investors aiming to develope technogenic deposits. These are the technological foundation and the organizational framework of the project (Fig. 4). However, the author does not justify the choice of instruments and instead focuses on outlining the procedures for obtaining investment.

The issue of formulating an effective set of economic instruments for the exploitation of technogenic deposits has been further addressed in more recent studies25. One such study proposes a range of instruments based on the criteria of economic and environmental efficiency of the processed waste. For high-profitability waste, the recommended incentives include various forms of credit – such as tax credits – and the use of an environmental entrepreneurship support fund. For moderately profitable waste, the suggested measures comprise tax incentives, credit guarantees, accelerated depreciation, and again, support from the same fund. In the case of low-profitability waste, the study proposes the use of subsidies, grants, tax incentives, and continued reliance on the environmental entrepreneurship support fund. Notably, this study does not offer a clear rationale for the selection of the proposed instrument – unlike the second study, in which the recommended instruments are aligned with the stages of R&D. In that work, the final selection of a specific incentive package is advised to be based on an evaluation of both commercial and budgetary efficiency, with priority given to maximizing commercial efficiency under conditions of positive – or at least neutral – budgetary effect.

Another study26 roposes a method for ranking investment projects for subsequent funding based on eleven evaluation criteria, each scored using a point-based system (Table 2).

Table 2

Evaluation criteria for investment project selection

| Criterion | Score (points) |

| Net present value (NPV) | 10 |

| Involvement of the local population / creation of new jobs | 10 |

| Environmental impact | 9 |

| Evaluation of the technology used in the project | 9 |

| Environmental and economic efficiency (environmental effect vs. CAPEX) | 8 |

| Extent of project documentation development | 7 |

| Profitability index | 6 |

| Positive attitude of authorities and local communities | 6 |

| Investment payback period | 5 |

| Internal rate of return (IRR) | 5 |

| Scale of the project’s environmental impact | 4 |

The authors examine eight potential sources of funding and justify the optimal financing structure for the investment projects under consideration, based on the use of equity financing. The identified funding sources include:

- the federal budget;

- regional budgets;

- funds from subsoil users;

- private investment;

- loans and credits;

- green bonds;

- public–private partnership (PPP) mechanisms;

- compensation funds (e.g. damage compensation to Indigenous Peoples);

- repatriated offshore assets.

To achieve this objective, the authors propose a three-stage algorithm. In the first stage, priority project initiatives are identified based on the needs and expectations of key stakeholders. The second stage involves ranking these projects using a predefined set of criteria. In the final stage, the most suitable projects are selected for implementation, taking into account the feasibility of equity financing. This structured approach helps optimize resource allocation while reducing the financial burden27.

19 Nadymov D. S. Development of an organizational and economic mechanism for the development of technogenic deposits using state development instruments. [Diss. ... Cand. Sci. (Econ.)] St. Petersburg; 2015. 157 p.

20 Umerov R. Z. Mechanisms of Economic Improvement in the Management of Industrial Waste in the Regions. [Abstr. ... Cand. Sci. (Econ.) Diss.] Moscow; 2000. 25 p.

21 Ledovskikh V. A. The Economic Mechanism of State Regulation of the Oil Refining Sector in Russia. [Abstr. ... Cand. Sci. (Econ.) Diss.] St. Petersburg; 2010. 20 p.

22 Belik I. S. Economic Mechanism for Incentivizing the Use of Industrial Waste. [Abstr. ... Cand. Sci. (Econ.) Diss.] Yekaterinburg; 1993. 24 p.

23 Pakhalchak G. Yu. Improvement of the Economic Mechanism for Processing Waste from Mining and Processing Industries. [Abstr. ... Cand. Sci. (Econ.) Diss.] Yekaterinburg; 1998. 19 p.

24 Mudretsov A. V. Economic Feasibility of Prioritizing Investment Projects for Mining Waste Recycling and Disposal. [Diss. ... Cand. Sci. (Econ.)] Moscow; 2003. 138 p.

25 Bogatyreva E. Yu. Toolkit for the Development of Environmental Entrepreneurship in the Field of Waste Management. [Abstr. Cand. Sci. (Econ.) Diss.] Yekaterinburg; 2015. 28 p.; Nadymov D. S. Development of an Organizational and Economic Mechanism for the Development of Technogenic Deposits Using State Development Instruments. [Diss. ... Cand. Sci. (Econ.)] St. Petersburg; 2015. 157 p.

26 Chávez Ferreira Katerine Yeshia. Development of an Economic Mechanism for Attracting Investment in Projects for the Integrated Development of Technogenic Mineral Deposits. [Diss. ... Cand. Sci. (Econ.)] Moscow; 2020. 156 p.

27 Ross S., Westerfield R., Jordan B. Fundamental of Corporate Finance. 12th Edition. 2019. GCTU Repository. URL: https://repository.gctu.edu.gh/items/show/720

2. Author’s methodological approach to оustifying an optimal set of instruments for technogenic deposit development: a model of the economic mechanism to stimulate TMA processing

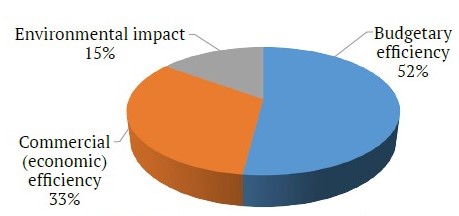

A review of academic literature on enhancing economic instruments for the development of technogenic deposits – whether by small, medium, or large businesses – reveals that the issue is still addressed in a rather fragmented way. The sets of proposed instruments are often neither well-substantiated nor systematically classified. Instead, most studies tend to focus on refining procedures for accessing financial resources to implement projects aimed at integrating technogenic deposits into economic circulation. Nevertheless, there is broad agreement among researchers that under market conditions, the core criteria for evaluating such projects and determining the appropriate set of instruments should be economic efficiency and environmental benefits. The authors of this study previously attempted to develop a simple and practical methodological approach for defining an optimal set of instruments for technogenic deposit development28, However, that approach did not take budgetary efficiency into account as a key criterion for project prioritization. Given the 2024 federal budget deficit of 1.7% of GDP and the planned 2025 deficit of 3.225 trillion rubles (1.5% of GDP), along with substantial ongoing national defense expenditures, budgetary efficiency has become the top priority. It is followed by commercial (or economic) efficiency, particularly in the context of international sanctions and the growing strategic importance of raw materials. Environmental impact remains important but takes a lower position in the hierarchy of criteria. This updated prioritization is supported by the findings of a brainstorming session involving 32 experts, including 12 representatives of public-sector institutions responsible for waste management and natural resource regulation, including subsoil use. At the first stage of the session, participants identified the most important criteria for evaluating investment projects in the mining sector focused on technogenic deposit development. The final results are presented in Fig. 5.

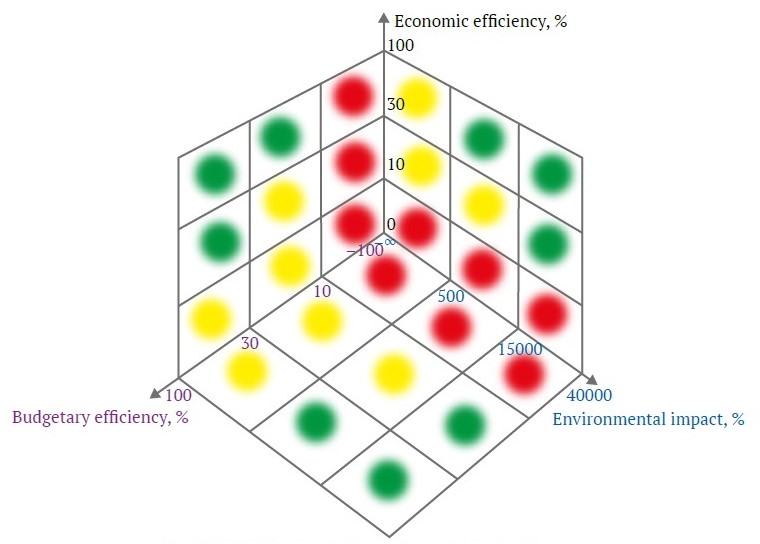

Based on these findings, the project ranking matrix for allocating resource support has been revised and is presented in a modified form (see Fig. 6).

Fig. 5. Brainstorming session results

Source: Compiled by the authors.

Fig. 6. Project ranking for resource support allocation:

green zone – high-priority projects; yellow zone – medium-priority projects; red zone – low-priority projects

Source: compiled by the authors.

In this figure, environmental impact is represented along a notional range (−∞; +∞). In practice, the environmental impact may also be negative (−∞), as there are cases where unscrupulous subsoil users cause environmental damage during TD development that exceeds the mitigated impact. The middle and upper thresholds for commercial (economic) efficiency and budgetary efficiency are set at 10, 30, and 100%, in line with standard investment analysis and project ranking practices. Budgetary efficiency is mathematically defined within the range (−100%; 100%). Projects marked in green are high-priority and recommended for funding first, based on the comparison of criteria (budgetary efficiency, commercial efficiency, and environmental impact). Yellow indicates medium-priority projects in terms of access to financial resources, while red denotes the low-priority group.

If we assign the variable D for commercial (economic) efficiency with subscript a, E for environmental impact with subscript b, and B for budgetary efficiency with subscript c, then the grid cells in the matrix shown in the figure can be described as follows: for commercial (economic) efficiency DHa, DMa, DLa, for environmental impact EHb, EMb, ELb, for budgetary efficiency BHc, BMc, BLc, where the second letters H, M, and L stand for high, medium, and low levels, respectively.

Accordingly, the green zone includes projects with the following combinations of evaluated criteria: [BHс; DHa]; [BHс; DMa]; [BMc; DHa]; [BHc; EHb]; [BHc; EMb]; [BMc; EHb]; [DHa; EHb]; [DHa; EMb]; [DMa; EHb]. The yellow zone includes: [BMc; DMa], [BHc; DLa], [BMc; DLa], [BHc; ELb], [BMc; ELb], [BMc; EMb], [DHa; ELb], [DMa; ELb], [DMa; EMb]. The red zone includes: [BLc; DHa], [BLc; DMa], [BLc; DLa], [BLc; ELb], [BLc; EMb], [BLc; EHb], [DLa; ELb], [DLa; EMb], [DLa; EHb].

The second stage of the brainstorming session focused on establishing the rationale for applying specific incentive instruments within the economic mechanism regulating the integration of technogenic mineral accumulations into economic circulation. The survey was conducted using a Delphi method (a simplified version by D. Peskov) involving the previously mentioned group of experts. The experiment included five rounds of consensus-building for each project group. Only those incentive instruments that received 53% or more of the expert votes (i.e., 17 or more experts) were selected. The results are presented in Table 3.

Verification of the obtained results for medium-priority projects using brainstorming and the Delphi method was performed by comparing them with the model-building approach (hypothetical case studies) employed in the study by D.S. Nadymov29. In his work, Nadymov addressed the task of developing an optimal selection of government support instruments aimed at incentivizing the development of technogenic deposits within a limited set of feasible solutions under discrete optimization and uncertainty. To test the proposed solutions, he selected the Allarechensk technogenic deposit development project, classified as a medium-priority project according to the author’s classification (see Fig. 6). Based on his calculations, the maximum net present value (NPV) can be achieved under Scenario 4 (Table 4).

Table 3

Incentive instruments

Project Group (see Fig. 6) | Incentive instruments | Frequency of expert support, % |

High-priority projects |

|

|

Medium-priority projects |

|

|

Low-priority projects |

|

|

Table 4

Scenarios for developing the Allarechensk TD using various government support instruments

Resulting value (NPV), thousand RUB | Scenarios | ||||||

0 | 1 | 2 | 3 | 4 | 5 | 6 | |

Subsoil user's NPV | −5072.5 | 548.4 | 5370.9 | 6033.9 | 12670.1 | 15557.2 | 19142.1 |

State NPV | 6135 | 0 | 18809.6 | 18146.6 | 13839.6 | 10944.7 | 5046.2 |

Total NPV | 1062.5 | 548.4 | 24180.5 | 24180.5 | 26509.7 | 26501.9 | 24188.3 |

Support instruments | No support | Zero one-time payment | Zero one-time payment | Zero one-time payment | Zero one-time payment | Zero one-time payment | Zero one-time payment |

Deduction of exploration costs from MET | Deduction of exploration costs from profit tax | Zero MET rate | |||||

Deduction of exploration costs from MET | Deduction of exploration costs from profit tax | Concessional R&D loan | Zero MET rate | Deduction of exploration costs from profit tax | |||

Concessional R&D loan | |||||||

Source: Compiled from: Nadymov D. S. Development of an organizational and economic mechanism for the development of technogenic deposits using state development instruments. [Diss. ... Cand. Sci. (Econ.)] St. Petersburg; 2015. p. 122.

In essence, the incentive instruments for the development of TMDs proposed and substantiated by D. S. Nadymov – based on detailed quantitative modeling – are largely consistent with the results obtained through the brainstorming session and the Delphi method for the medium-priority project group. The primary difference lies in the type of tax from which exploration expenses are deducted: in the present study, the deduction is applied to corporate income tax, whereas Nadymov’s analysis considered deductions from the mineral extraction tax (MET). Another distinction is the inclusion of government guarantees among the expert-identified support instruments, which were not accounted for in Nadymov’s study. Otherwise, the sets of instruments show substantial overlap.

D. S. Nadymov also compared the Allarechensk TD with two hypothetical deposits of larger scale (1.5 and 1.25 times greater in reserves, respectively), which were classified as high-priority projects (green zone). He concluded that NPV for both the subsoil user and the state may vary significantly in absolute terms. This suggests that a different configuration of economic instruments may be required to maximize NPV for both parties. This finding is in line with the results of the present study, which identified the following as the most effective instruments for high-priority projects: concessional loans, deduction of exploration expenses, and the investment tax credit.

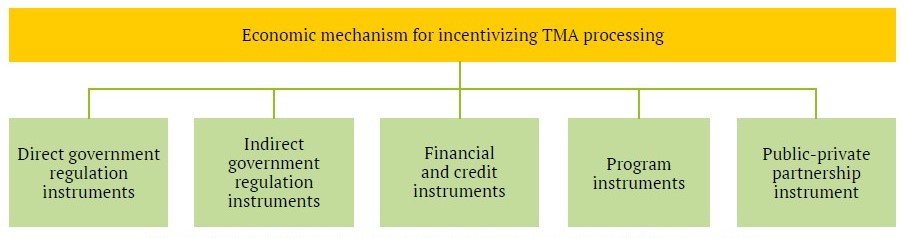

The expert survey conducted among leading specialists in TMA processing also provided the basis for a subsequent analysis of the data presented in Table 1, aimed at developing a general model of the economic mechanism for incentivizing TMA processing. As an initial step, the identified instruments were categorized according to the key components of the mechanism (Table 5), resulting in the following classification: direct instruments (subsidies, loans, etc.), indirect instruments (preferential tax treatment), financial and credit instruments, program-based support, and PPP.

Table 5

Economic incentive instruments for TMA processing by mechanism element

Authors | Economic instruments proposed by researchers | Corresponding mechanism elements |

| Nadymov D. S.30 | Deduction of geological exploration expenses from MET | Tax incentives |

Elimination of one-time payment | Tax incentives | |

Chernyavsky A. G. [12] | Exemption from MET | Tax incentives

|

Kubarev M. S., Ignatieva M. N. [16] | Exemption of marketable products derived from TMAs from income tax; Tax rate reduction or full exemption for 1.5–2 years upon introduction of new technologies; Full exemption for eco-friendly technologies (investment tax credit); Subsidies for clean tech development and interest payment on loans; Loans for installation of eco-tech equipment; Reduction or exemption of property tax; Reduction or exemption of municipal property lease fees; Concessional loans (guaranteed by regional government) | Tax incentives Tax incentives Direct government regulation /Government support programs Direct government regulation /Government support programs Tax incentives Government support programs Financial and credit policy |

Kiperman Y. A., Komarov M. A. [30] | Exemption from income tax and MET | Tax incentives

|

Seleznev S. G., Boltyrov V. B. [39] | Elimination of income tax | Tax incentives

|

Mirzekhanov G. S. [40] | Reduction of taxable income base when purchasing new technological equipment; Elimination of MET; Deduction of exploration expenses for technogenic deposits | Tax incentives Tax incentives Tax incentives |

Boyarko G. Yu. [41] | 50% reduction of VAT rate | Tax incentives |

Klemez T. N. [42] | Use of environmental coefficients in MET calculation | Tax incentives |

Seleznyov S. G. [43] | Exemption from income tax and MET | Tax incentives |

Sukhoruchenkov A. I., Kornilov N. P., Evsin V. G. [44] | Income tax exemption on revenue allocated to advanced technologies; Reduction of MET rates | Tax incentives

Tax incentives |

Ochilov S., Kadirov V., Umirzoqov A., Karamanov A., Xudayberganov S., Sobirov I. [45] | Deduction of exploration expenses for technogenic deposits (from tax base) | Tax incentives

|

Machado C. [46] | Elimination of income tax; Concessional loans | Tax incentives Financial and credit policy |

Ignatyeva M. N., Yurak V. V., Dushin A. V., Strovsky V. E. [35] | Implementation of the PPP mechanism | Public–private partnerships (PPPs) |

Potravny I., Novoselov A., Novoselova I., Gassiy V., Nyamdorj D. [47] | Reduction of TMA exploration costs | Tax incentives/ Government support programs

|

Butkevich G. R. [48] | Subsidies for clean tech development; Loans for the installation of clean technologies; Concessional loans and state guarantees | Direct government regulation /Government support programs Direct government regulation /Government support programs Financial and credit policy |

Goldyrev V., Naumov V., Kovyrzina U. [49] | Reduction of TMA exploration costs | Tax incentives/ Government support programs |

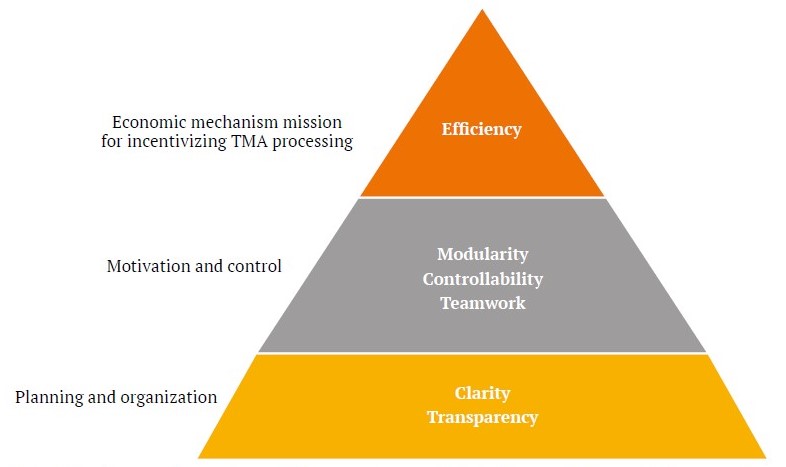

During the prioritization of incentive instruments for TMA processing within the brainstorming framework, it was established that the efficiency of each instrument depends on the conditions of its implementation. This highlighted the need to develop a system of fundamental principles for constructing an economic mechanism that promotes the development of technogenic deposits. From the perspective of management theory, the principles can be categorized according to key functions: planning, organization, motivation, and control. Accordingly, the foundational principles include: clarity – the precision and comprehensibility of each instrument’s purpose and functioning; transparency – openness in the management of instruments from both organizational and legal standpoints. When both the regulator and subsoil user have a clear understanding of the nature and application rules of these instruments, and when roles and responsibilities are well-defined, the planning and organizational levels of the economic regulation mechanism for technogenic deposit development can function effectively. At the levels of motivation and control, the following principles are proposed: teamwork, which implies joint involvement of subsoil users and public legal entities in organizing development activities, with an emphasis on the government’s role in actively supporting subsoil users; modularity, which ensures the flexibility to easily replace, supplement, or remove instruments; controllability, which, although related to transparency, differs in that transparency ensures process visibility, while controllability focuses on managing the processes and their key parameters. The final principle in the proposed framework is efficiency, defined as the economic mechanism’s ability to deliver maximum outcomes with minimal costs for all stakeholders – subsoil users, regulators, the natural environment, and society at large. Thus, the principles form a kind of Maslow’s hierarchy (Fig. 7), in which the failure to meet foundational (lower-level)principles prevents the realization of higher-level ones, ultimately making the achievement of the final principle – efficiency – unattainable.

Fig. 7. Fundamental principles of the economic mechanism for incentivizing TMA processing

Source: compiled by the authors.

Fig. 8. Model of the economic mechanism for incentivizing TMA processing

Source: compiled by the authors.

Based on the findings from all of the methods outlined above – including the expert survey conducted using the Delphi method – and the set of foundational principles formulated by the authors, the proposed economic mechanism for incentivizing the processing of TMAs takes the form presented in the model below (Fig. 8).

Among the indirect instruments (i.e., tax incentives), the experts identified several particularly relevant measures: full or partial exemption from corporate income tax, full or partial exemption from the mineral extraction tax (MET), exemption from the one-time payment, exemption from property tax, and exemption from or reduction of land tax rates. A certain ambiguity remains regarding policy planning in the field of waste management at various levels: federal government support programs, as well as regional, sectoral, and local-level programs. Previously, the development of such target programs was considered part of the economic incentive mechanism. However, according to Federal Law No. 122-FZ of October 22, 2004 “On Amendments to Legislative Acts of the Russian Federation and Invalidation of Certain Legislative Acts,” target programs were excluded from the list of economic instruments. This may have been associated with the adoption of Federal Law No. 115-FZ of July 20, 1995 “On State Forecasting and Programs of Socio-Economic Development of the Russian Federation,” which sets out requirements for forecasting and planning socio-economic development, including aspects related to the management of industrial and consumer waste. The authors support the position of researchers who argue that excluding waste management planning from the list of economic instruments is unjustified.

Public–private partnerships (PPP) are recognized by many researchers as a promising instrument within the economic mechanism for incentivizing TMA processing [50, 51]. Such partnerships involve pooling resources and sharing risks between the state and private business31, ultimately resulting in mutual benefit [52–54].

Promising PPP formats and mechanisms may include:

- government equity participation (i.e., investment of public funds in a company’s charter capital);

- government lending for innovation projects;

- tax incentives;

- state guarantees;

- interest rate subsidies32 [55].

28 Komarova O. G. Toolkit of the Organizational and Economic Mechanism for the Development of Technogenic Mineral Deposits. [Cand. Sci. (Econ.) Diss.]. Yekaterinburg; 2025. 224 p.

29 Nadymov D. S. Development of an Organizational and Economic Mechanism for the Development of Technogenic Deposits Using State Development Instruments. [Cand. Sci. (Econ.) Diss.]. St. Petersburg; 2015. 157 p.

30 Nadymov D. S. Development of an Organizational and Economic Mechanism for the Development of Technogenic Deposits Using State Development Instruments. [Diss. ... Cand. Sci. (Econ.)] St. Petersburg; 2015. 157 p.

31 Nadymov D. S. Development of an Organizational and Economic Mechanism for the Development of Technogenic Deposits Using State Development Instruments. [Diss. ... Cand. Sci. (Econ.)] St. Petersburg; 2015. 157 p.

32 Ivanov V. S. Public–Private Partnership as a Factor of Government Support for the Innovative Development of the Region and Enterprises. [Abstr. Cand. Sci. (Econ.) Diss.] St. Petersburg; 2009. 18 p.

Conclusion

Thus, the aim of this study – to develop more effective instruments of the economic mechanism (including for small businesses) to incentivize investment in the development of technogenic mineral accumulations (TMA) – was achieved through the following steps: analyzing the instruments of the economic mechanism that stimulate TMA processing; developing an original methodological approach to justify an optimal set of instruments for TMA development; and proposing a model of the economic mechanism for incentivizing TMA processing. The authors’ approach was enhanced by incorporating three key evaluation criteria, prioritized in the current geopolitical context of the Russian Federation in the following order: (1) budgetary efficiency, (2) commercial (economic) efficiency, and (3) environmental impact.

The proposed hypothesis – that an efficient set of economic instruments (including those accessible to small businesses) would promote investment in TMA development – was confirmed both by international experience and by the results of a brainstorming session involving 32 experts. Among them, 12 were representatives of public legal entities involved in managing industrial and consumer waste and regulating natural resource use, including subsurface use; the remainder represented the academic and business communities.

The expert survey based on the Delphi method (adapted using D. Peskov’s simplified format) produced the following ranking of efficient instruments – also relevant to small businesses – tailored to three project groups for TMA development:

- for the green project group, the most efficient and preferred instruments were: investment tax credit (100%), followed by bank loans (97%), preferential taxation (corporate income tax, mineral extraction tax (MET), and one-time payments) (91%), and lastly, deduction of technogenic deposit (TD) exploration expenses (56%);

- for the yellow project group, the top-rated instrument was state guarantees (100%), followed by preferential taxation (94%) and deduction of TD exploration expenses (78%);

- for the red project group, the instruments were ranked in descending order of efficiency and preference as follows: preferential taxation (corporate income tax, MET, one-time payments, property tax, and land tax) (97%), subsidies (91%), concessional loans (84%), reduced lease payments (72%), and deduction of TD exploration expenses (66%).

The authors’ findings for the yellow project group are consistent with the detailed calculations and rationale provided in the study by D.S. Nadymov, where the highest net present value (NPV) (26.51 million RUB for the Allarechensk TD project) was achieved in scenario 4. This scenario incorporated economic instruments such as zero one-time payments, deduction of geological exploration expenses from MET, and concessional loans for R&D. Nadymov also compared these results with two hypothetical deposits of 1.5 and 1.25 times greater reserves (green project group) and concluded that both the NPV for subsurface users and the state can vary significantly depending on the instruments applied. Therefore, a different set of economic instruments is required to increase both values, which is also confirmed by the current study – since for the green group, a different set of instruments proved most efficient. This supports the objectivity of the results obtained via the brainstorming and Delphi methods.

The study also proposed a set of fundamental principles to underlie the overall model of the economic mechanism for incentivizing TMA processing. These include: Clarity – the essential purpose and operational logic of each instrument must be clearly defined and understandable; transparency – the management of instruments must be transparent in both organizational and legal aspects; teamwork – collaboration between subsoil users and public legal entities in organizing TMA development efforts, with active support from public authorities; modularity – the flexibility to replace, add, or remove instruments with ease; controllability – the ability to manage and monitor key governance parameters; efficiency – the capacity of the economic mechanism to deliver maximum benefits for subsurface users, regulators, the environment, and society at large, while minimizing costs. As a result, the baseline economic mechanism for incentivizing TMA processing – including for small businesses – consists of the following blocks: preferential taxation, financial and credit policy, program instruments, and public–private partnerships (PPP). It should be noted that the list of instruments does not vary by company size: whether small, medium, or large, the same set of instruments applies. However, their efficiency will differ depending on company size. The only exception for small businesses is the limited applicability of PPPs, which require amendments to the existing regulatory framework. In all other respects, the economic instruments available to small businesses are identical to those for larger enterprises.

Thus, implementing the proposed recommendations for ranking investment projects enables two outcomes: first, it allows projects to be grouped and matched with a tailored package of economic instruments to promote investment in TD development; second, it provides a general model for an economic mechanism that incentivizes TMA processing. Enhancing this mechanism’s toolset will undoubtedly stimulate more active engagement in the management and processing of technogenic mineral accumulations.

References

1. Soelton M., Permana D., Ramli Ya. et al. Business plan counseling in creating micro- entrepreneurship at Kemanggisan-Jakarta. In: International Conference on Community Development (ICCD) 2023. 2023;5(1):266–271. http://dx.doi.org/10.33068/iccd.v5i1.589

2. Kuznetsova S., Kozlova E., Kuznetsova A. Innovative entrepreneurship. Moscow Economic Journal. 2024:9(2):156–166. http://doi.org/10.55186/2413046X_2023_9_2_75

3. Keim J., Mueller S., Dey P. Whatever the problem, entrepreneurship is the solution! Confronting the panacea myth of entrepreneurship with structural injustice. Journal of Business Venturing Insights. 2024;21:e00440. http://doi.org/10.1016/j.jbvi.2023.e00440

4. Sokolovsky A. V., Gonchar N. V. Assessment of directions to use man-made resources in the development of various types of mineral raw materials. Russian Mining Industry. 2023;(5):102–107. (In Russ.) http://doi.org/10.30686/1609-9192-2023-5-102-107

5. Petlovanyi M., Kuzmenko O., Lozynskyi V. et al. Review of man-made mineral formations accumulation and prospects of their developing in mining industrial regions in Ukraine. Mining of Mineral Deposits. 2019; 13: 24–38. http://doi.org/10.33271/mining13.01.024

6. Kradenykh I. A., Litvintsev V. S. Gold industry medium and small-sized business future development. News of the Higher Institutions. Mining Journal. 2016;(7):34–41. (In Russ.)

7. Umirzoqov A., Jurayev S., Karamanov A. Economic and mathematical modeling of rational development of small-scale and man-made gold deposits. International Journal of Academic and Applied Research. 2020;4(4):75–77.

8. Panfilov E. I. On the fundamentals of small-scale mining entrepreneurship. Russian Mining Industry. 2015;(5):26–29. (In Russ.)

9. Gafiyatov I. Z. World experience of using small enterprises in the subsoil use sector. Problems of Modern Economics. 2007;(2):150–153. (In Russ.)

10. Morozov V. A. Gold mine of big dividends: small business in the mineral mining sector. Russian Journal of Entrepreneurship. 2002;(12):9–14. (In Russ.)

11. Orlov V. P. Challenges of small mining business. Mineral Recourses of Russia. Economics and Management. 2008;(5):24–28. (In Russ.)

12. Chernyavsky A. G. Regarding the issue of technogenic resources development. Mineral Recourses of Russia. Economics and Management. 2020;(3):58–64. (In Russ.)

13. All-Russian Conference "Problems of Rational Use of Mining and Industrial Waste". Mineral Resources of Russia. Economics and Management. 2013;(4):95–98.

14. Nevskaya M., Cherepovitsyn A.E. Justification of an approach to an economic assessment of projects development of technogenic mineral objects. In: IOP Conference Series: Earth and Environmental Science, Volume 302, 4th International Scientific Conference "Arctic: History and Modernity". 17–18 April 2019, Saint Petersburg, Russian Federation. 2019;302:012049. http://doi.org/10.1088/1755-1315/302/1/012049

15. Pakhalchak G. Yu. The state, demanding enterprises to keep conservation measures, doesn’t hurry to perform their own duties. Diskussiya. 2016;(7):6–11. (In Russ.)

16. Kubarev M. S., Ignatieva M. N. Economic stimulation of processing of technogenic mineral education. Samarskaya Luka: Problemy Regional'noy i Global'noy Ekologii. 2018;(3):143–147. (In Russ.)

17. Polyanskaya I. G., Yurak V. V., Strovsky V. E. Considering mining wastes as a factor of increasing the balance level of subsoil management in regions. Economy of Region. 2019;15(4):1226–1240. (In Russ.) https://doi.org/10.17059/2019-4-20

18. Petrova T. V. Legal issues of the economic mechanism for environmental protection. Moscow: Zertsalo Publ.; 2000. 192 p. (In Russ.)

19. Miletenko N. V. Ecological and mining-geological dimensions of sustainable development concept realization. Prospect of mineral resources. 2012;(7):5–7. (In Russ.)

20. Mirzekhanov G., Mirzekhanova Z. From placer deposits to technogenic mineral formations: resource and historical perspective (a study of Amur region). In: E3S Web of Conferences. VIII International Scientific Conference “Problems of Complex Development of Georesources. 2020;192:01032. https://doi.org/10.1051/e3sconf/202019201032

21. Chanturia V. A. Prospects for Sustainable Development of Russia's Mining and Processing Industry. Scientific Report at the Meeting of the Russian Academy of Sciences. Moscow; 2006. 30 p. (In Russ.)

22. Shulepina Z.M., Anfilatova N.V., Kovaleva E.N. et al. Technogenic resources of Russia: general information. Reference Book. Moscow: Geoinformmark Ltd. 199 p. (In Russ.)

23. Mikhailov B. K. (Ed.). Technogenic Mineral Resources. Moscow: Nauchnyi Mir; 2012. 236 p. (In Russ.)

24. Chaikovnikov V. V. Systematic assessment of technogenic deposits. In: Geology, exploration methods, and evaluation of solid mineral deposits: review information. Issue 6–7. Moscow: Geoinformmark; 1999. 75 p. (In Russ.)

25. Dushin V. A., Makarov A. B. Nontraditional types of mineral deposits. Yekaterinburg: UGGU; 2015. 224 p. (In Russ.)

26. Potravny I. The economics of resource conservation in the FRG. World Eсonomy and International Relations. 1990;(1):123–128. (In Russ.) https://doi.org/10.20542/0131-2227-1990-1-123-128

27. Ecology: experience of state regulation in the USA. Scientific-analytical review. Moscow: INION RAN; 1995. 36 p. (In Russ.)

28. Ibatullin U. G. Is it profitable to invest in waste dumps? Tabigat. 2004;(5):12–14. (In Russ.)

29. Morand-Deviller J. Droit de l'environnement. Paris: Editions ESTEM; 1996. (In Fr.)

30. Kiperman Y. A., Komarov M. A. Mining waste in the formation of resource saving environmental policy. Mineral Recourses of Russia. Economics and Management. 2016;(1–2):68–73. (In Russ.)

31. Ignatyeva M., Yurak V., Dushin A. et al. How far away are world economies from circularity: Assessing the capacity of circular economy policy packages in the operation of raw materials and industrial wastes. Sustainability. 2021;13(8):4394. https://doi.org/10.3390/su13084394

32. Georghiou L., Cassingena J., Keenan M. et al. The handbook of technology foresight: concepts and practice. Cheltenham: Edward Elgar Publishing; 2008. 428 p.

33. Popper R. How are foresight methods selected? Foresight. 2008;10(6):62–89. http://dx.doi.org/10.1108/14636680810918586

34. Pakhalchak G.Y. Problems of industrial and consumer waste management and solutions (case study of Sverdlovsk region). In: Proceedings of the II Ural International Ecological Congress. May 17–20, 2011, Yekaterinburg, Perm. Pp. 93–96. (In Russ.)

35. Ignatyeva M. N., Yurak V. V., Dushin A. V., Strovsky V. E. Technogenic mineral accumulations: problems of transition to circular economy. Mining Science and Technology (Russia). 2021;6(2):73-89. https://doi.org/10.17073/2500-0632-2021-2-73-89

36. Ignateva M. N., Litvinova A. A., Loginov V. G. Methodological tools for economic assessment of the environmental impact of mining complexes. Yekaterinburg: IE UrO RAN; 2010. 168 p. (In Russ.)

37. Pashkevich M. A., Parshina M. V. Analysis of environmental hazards at coal industry facilities. Mining Informational and Analytical Bulletin. 2007;(10):305–312. (In Russ.)

38. Baev L. A., Afanasev Ya. V. Economic foundations of waste management in metallurgical production. Ecology and Industry of Russia. 2004;(1):37–40. (In Russ.)

39. Seleznev S. G., Boltyrov V. B. Legal framework of the development of man-made facilities of minerals to conditions of Pechenga district of Murmansk region. News of the Higher Institutions. Mining Journal. 2013;(8):73–79. (In Russ.)

40. Mirzekhanov G. S. State policy on optimizing the development of technogenic raw material base of placer gold deposits. News of the Higher Institutions. Mining Journal. 2008;(2):33–36. (In Russ.)

41. Boyarko G. Yu. Value-added tax in mineral raw materials production. Gornyi Zhurnal. 2001;(4):14-7. (In Russ.)

42. Klemez T. N. Tax stimulation of environmental security in mining industry. Gornyi Zhurnal. 2013;(7):47–50. (In Russ.)

43. Seleznyov S. G. On the problem of mining waste management. Mineral Recourses of Russia. Economics and Management. 2013;(4):40–44. (In Russ.)

44. Sukhoruchenkov A. I., Kornilov N. P., Evsin V. G. Problems and ways of improvement of legislative base in the field of usage of the earth bowels. Gornyi Zhurnal. 2009;(5):8–12. (In Russ.)

45. Ochilov S., Kadirov V., Umirzoqov A. et al. Ore stream management on the development of deposits of natural and technogenic origin. In: The 1st International Conference on Problems and Perspectives of Modern Science: ICPPMS-2021. 10–11 June 2021, Tashkent, Uzbekistan. 2022;2432(1):030061. https://doi.org/10.1063/5.0093311

46. Machado C. Urban expansion and the formation of technogenic deposits in tropical areas: The case of Araguaína city. Investigaciones Geográficas. 2014;47:3–18. https://doi.org/10.5354/0719-5370.2014.32991

47. Potravny I., Novoselov A., Novoselova I. et al. The development of technogenic deposits as a factor of overcoming resource limitations and ensuring sustainability (case of Erdenet Mining Corporation SOE in Mongolia). Sustainability. 2023;15:15807. https://doi.org/10.3390/su152215807

48. Butkevich G. R. Integrated development of technogenic resources. Stroitel'nye Materialy. 2023;819:70-74. https://doi.org/10.31659/0585-430X-2023-819-11-70-74

49. Goldyrev V., Naumov V., Kovyrzina U. Resource potential of technogenic-mineral formations of Santo Tomas II Gold-Copper-Porphyry Deposit (Philippines). In: Isaeva, E., Rocha, Á. (eds) Science and Global Challenges of the 21st Century – Innovations and Technologies in Interdisciplinary Applications. Perm Forum 2022. Lecture Notes in Networks and Systems. 2023;622. Springer, Cham. https://doi.org/10.1007/978-3-031-28086-3_31

50. Pakhalchak G. Yu. The role of state and business partnership in economic regulation of priority ecology problems. Diskussiya. 2014;(8):74–79. (In Russ.)

51. Tkachenko I. N., Evseeva M. V. The Stakeholder model of corporate governancein the public-private partnership projects. Management Sciences. 2014;(1):26–33. (In Russ.)

52. Yastrebinskiy M. A., Guseva N. M. Financial-economic potential of state and private partnership and live cycle contracts (pro et contra). Gornyi Zhurnal. 2014;(1):43–47. (In Russ.)

53. Ignatyeva M. N., Yurak V. V., Dushin A. V., Polyanskaya I. G. Assessing challenges and threats for balanced subsoil use. Environment, Development and Sustainability. 2021;23(12):17904–17922. https://doi.org/10.1007/s10668-021-01420-1

54. Kushnir M. A. Public-private partnerships in the development of mineral deposits. Mining Informational and analytical bulletin. 2019;(2):221–229. (In Russ.) https://doi.org/10.25018/0236-1493-2019-02-0-221-229

55. Filatova I., Nikolaichuk L., Zakaev D., Ilin I. Public-private partnership as a tool of sustainable development in the oil-refining sector: Russian case. Sustainability. 2021;13(9):5153. https://doi.org/10.3390/su13095153

56.

About the Authors

V. V. YurakRussian Federation

Vera V. Yurak – Dr. Sci. (Econ.), Associate Professor, Professor of Industrial Economics Department; Head of the Research Laboratory for Reclamation of Disturbed Lands and Technogenic Objects, Director of the Research Laboratory

Center; Leading Researcher

Saint Petersburg

Yekaterinburg

Scopus ID 57190411535

ResearcherID J-7228-2017

M. N. Ignatyeva

Russian Federation

Margarita N. Ignatyeva – Dr. Sci. (Econ.), Professor, Professor of the Department of Economics and Management, Chief Researcher of the Research Laboratory for Reclamation of Disturbed Lands and Technogenic Objects; Leading Researcher

Yekaterinburg

Scopus ID 6603156023

O. G. Komarova

Russian Federation

Oksana G. Komarova – Senior Lecturer, Department of Economics and Management

Yekaterinburg

Review

For citations:

Yurak V.V., Ignatyeva M.N., Komarova O.G. Economic incentive instruments for the development of technogenic deposits. Mining Science and Technology (Russia). 2025;10(2):180-200. https://doi.org/10.17073/2500-0632-2024-09-255